Read time: 3 min

The first time you see a term sheet, it feels like validation.

Finally. Someone believes in you.

Someone’s about to wire real money into your account.

Your dream’s about to scale.

But buried in those 5–7 pages of “standard clauses” are traps that have cost founders millions, and in some cases, their companies.

I’ve seen it happen.

More than once.

Here are the 3 big ones I wish someone had shown me earlier.

1. The option pool shuffle

A founder I coached raised $3M seed.

The lead investor said: “We just need you to top up the option pool to 20% before the round. Totally standard.”

She signed. Didn’t think much of it.

Six months later, when she modeled her cap table again, she realized she’d effectively given away an extra 12% ownership. The investor hadn’t budged an inch. The dilution was all on her side.

That 20%? It wasn’t “totally standard.” It was leverage.

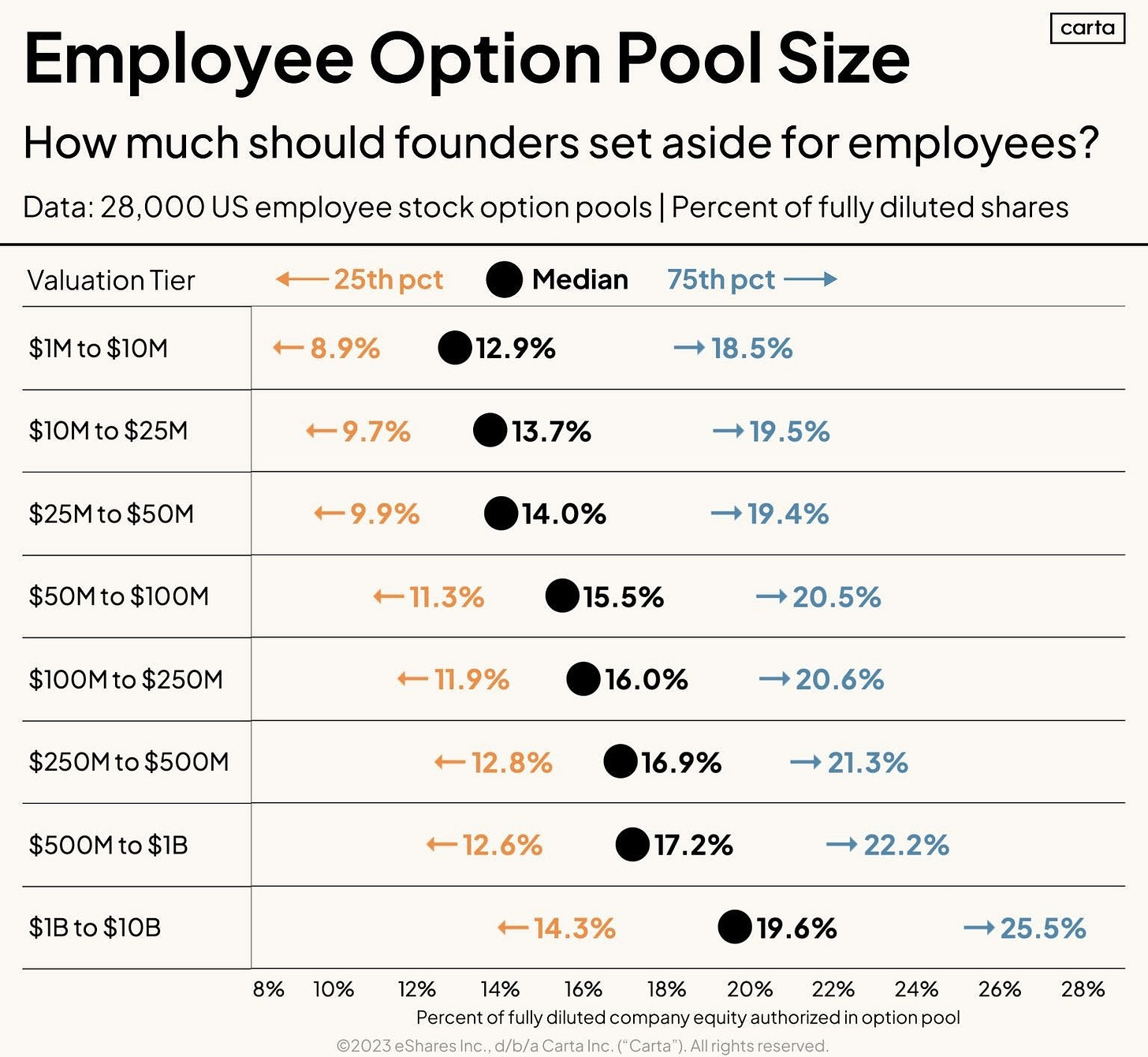

👉 Action: Check your draft. If the option pool sits “pre-money,” you’re eating all the dilution. Push it post-money. Cap it at 10–15%.

2. Liquidation preference creep

Another founder sold his climate hardware startup for $40M.

Investors had put in $8M at Series A.

He thought he’d walk away with life-changing money.

Instead, he got… almost nothing.

Why?

Buried in the docs was a 2x participating preference.

So at exit:

Investors first took $16M (2x).

Then they shared pro-rata in the remaining $24M.

By the time it trickled down, the founder barely cleared his mortgage.

He told me later:

“I’d built a $40M company and felt like an employee with a bonus.”

👉 Action: Never accept more than 1x non-participating. Circle it, bold it, put it on your fridge. Anything else = 🚩.

3. Full ratchet anti-dilution

This one is the silent killer.

I knew a founder who raised at a $12M valuation.

Tough market. The next round came in at $6M.

Sounds painful, but survivable.

Except… his seed term sheet had a full ratchet clause.

That meant his early investors reset their ownership as if they’d invested at the $6M valuation. Overnight, his personal stake shrank by 25%.

He texted me that night:

“I thought I’d raised capital. Turns out I’d signed a time bomb.”

👉 Action: Read your anti-dilution clause. If it says “full ratchet,” don’t walk, run. Accept only weighted average.

TL;DR

Option pool shuffle = hidden dilution.

Liquidation preference creep = double-dipping investors.

Full ratchet = cap table death spiral.

Your term sheet isn’t just paperwork.

It’s your company’s constitution.

And the wrong clause can rob you of everything you’ve fought to build.

So here’s my advice:

📌 Read every line.

📌 Run the numbers.

📌 Ask dumb questions until it’s clear.

You don’t need to be a lawyer.

You just need to protect yourself long enough for your dream to survive.

Founder tools that will give you the ultimate unfair advantage:

✍️ The Term Sheet template every founder should have (before talking to VCs)

📌 The Ultimate Investors List of Lists (12,000 VCs, FOs, Angels)

🦄 40 pitch decks that built Unicorns (how Airbnb, Coinbase, Canva got funded)

⚡️ The Ultimate Notion Data Room (all key docs you’ll EVER need)

🥇 The Most Successful Investor Update Template

📊 The Only Finance Tracker Your Startup Needs

All inside the Premium Plan, plus 40+ other tools, guides, and databases.

🎁 Get 20% off until August 31, that's 73% cheaper than monthly.

Hi Joann, I signed up for the Premium Plan and need your help in accessing the Founder Tools that you make available to members. How do I find them? Thanks for getting back with the information.