Read time: 4min

Welcome to 2024 everybody! 🥳 Let's prepare for what a bull case could look like for Climate.

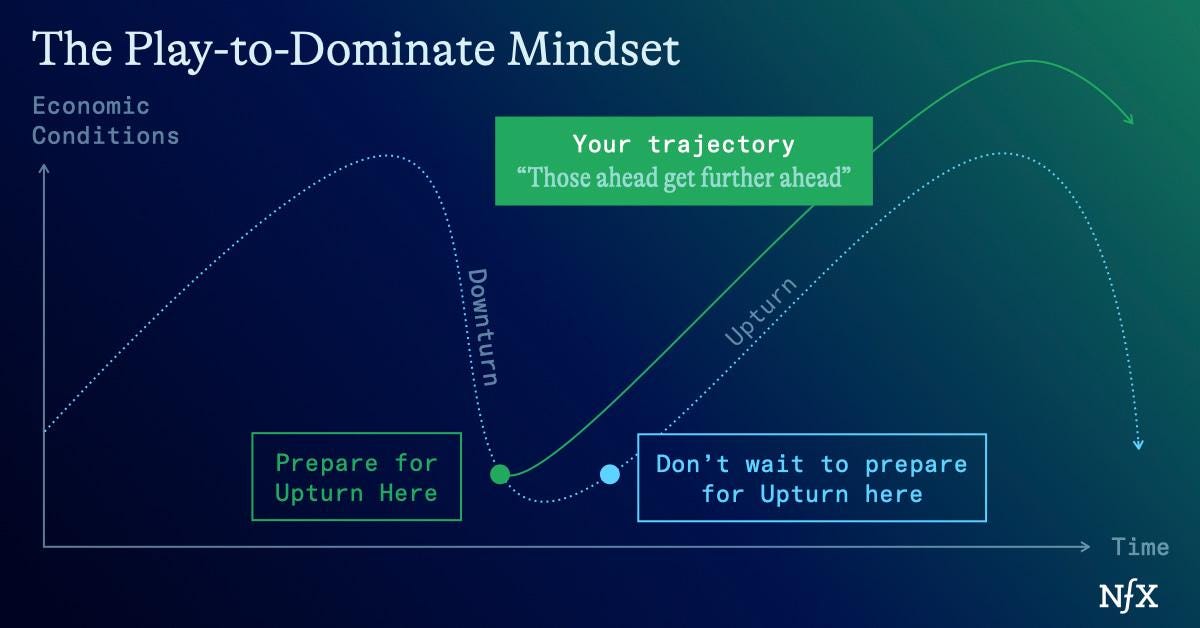

The 2000 downturn lasted for about 3 years. The 2008 downturn lasted approximately 14 months. The current downturn began in Q1 2022, so we are currently 2 years in.

Being well prepared and taking the first steps forward can provide a significant advantage over your competitors.

These initial steps are crucial due to a mathematical principle in networks known as preferential attachment. This principle states that the more connected a node is, the more likely it is to receive new links.

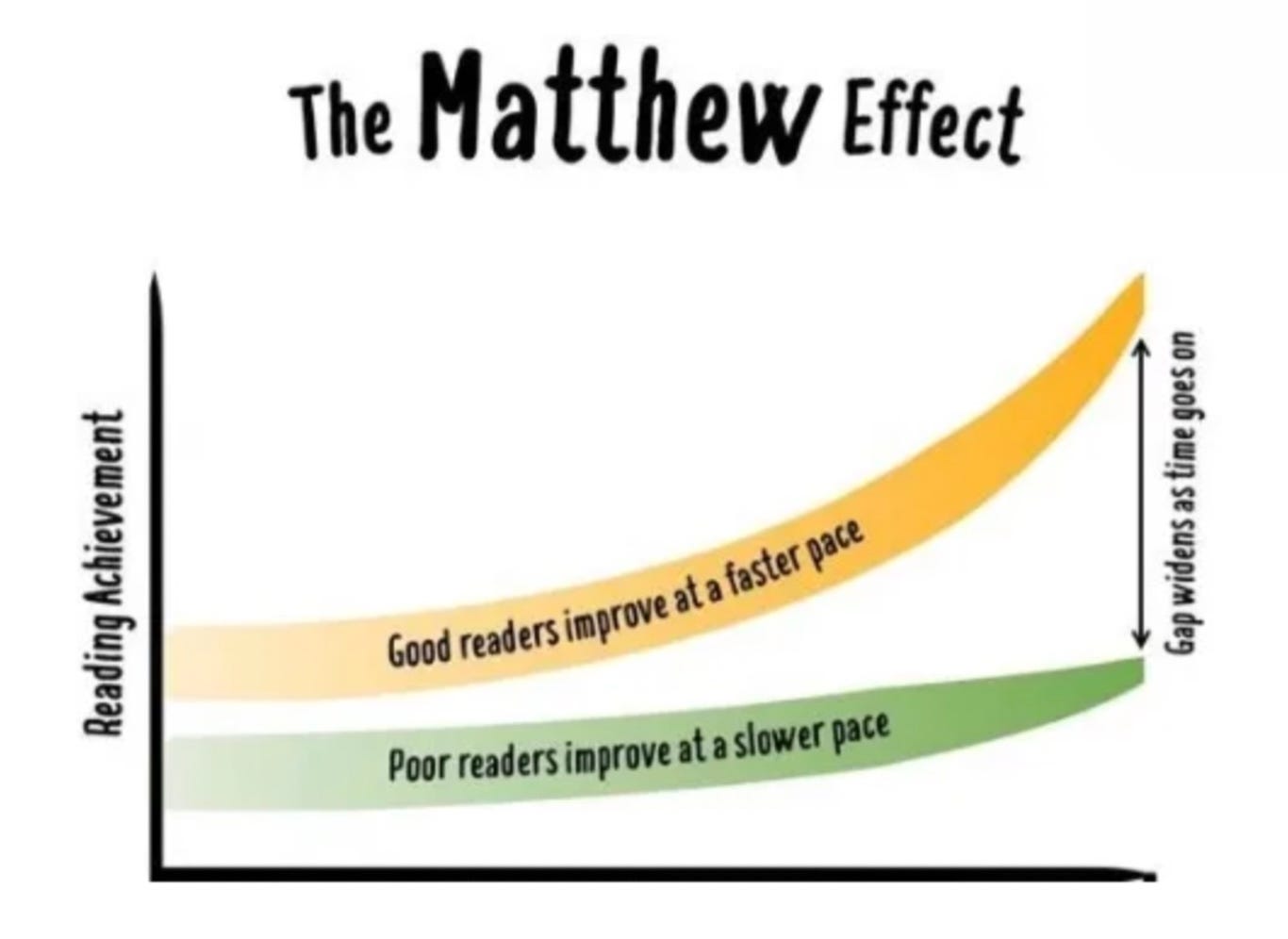

In any network, nodes that are already ahead tend to further distance themselves from others. This phenomenon is also referred to as The Matthew Effect.

“Those who begin with advantage accumulate more advantage over time and those who begin with disadvantage become more disadvantaged over time.” - The Matthew Effect

Want a practical example of The Matthew Effect?

Same goes for startups and Venture Capital. Whoever starts ahead, gets further ahead. Your job as a Climate Founder or Investor is to get two steps ahead of everyone. Then your lead will compound.

Change Your Mindset: Play-to-win

You need to move your mindset from the appropriate mindset of play-not-to-lose, to play-to-win (or playing Offense).

At the beginning of the downturn, Y Combinator and some of the Top VCs recommended their founders to shift their mindsets to get frugal, do layoffs quickly and with grace, and plan for the worst.

The same thing will happen when the market upswing begins.

The best founders will shift their mindsets just ahead of the new information. They will prepare for the upswing. They will move into a play-to-win mindset.

Get Capitalized

Collect the money from the tree before anyone else does 🌴

When an upturn comes, everyone will recognize it and try to raise capital then. If you are capitalized a bit ahead, you’ll be a step ahead.

Pound the pavement with VCs now. Don’t be as sensitive to valuation, show the best metrics, paint the picture of good times ahead, and explain why you’re raising now – to get ahead.

You have to move the investor to join you in the play-to-win mindset.

And be prepared that fundraisings at the end of a downturn are still in a downturn, so they will still be more complex and take longer than you hoped.

Stay Frugal

Fundraising, yes. However, we are not in YOLO mode yet! 💸

That’s the hardest and most valuable mental gymnastics you can do as a Founder: staying really frugal while playing-to-win.

If you stay frugal through a boom you win twice.

Prepare Your Company Culture

Your company's culture may have been damaged, either through layoffs or the overall downturn in morale.

With a lean team in place, now is the opportune time to review and improve your culture, preparing it for the eventual upswing. Moving swiftly during an upswing will be crucial to capitalize on your small lead, and only strong cultures are able to act quickly.

Conclusion

Prepare for the upturn, get a step ahead and adopt the play-to-win mindset. That advantage of being a few months early can compound over weeks and months into a permanent defensibility, and the chance to build something that matters 💪🌎

Want to get exposure to the best Climate Tech deals with us?

👉 Join the Climate Insiders investor community 🚀 Together, we are investing in fantastic early-stage Moonshot Climate deals. Whether you are looking for unique deal flow, wanting to develop your Angel track, or simply seeking exposure to the best projects in the space, fill out this form to join the community.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏