5min to ensure your Board gatherings shine 💥

You are now 1,616 readers! 🔥 If you enjoy this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏

So many startups are suffering from poor leadership.

Not executive leadership, but Board leadership.

Why?

Because VCs have it backwards. They are here to control and monitor.

Instead, they should be here to help!

🔴 What NOT to do

Avoiding the core topics

When discussing important or uncomfortable topics, it is best to address them upfront instead of delaying or avoiding them. These topics usually require the most attention and should be prioritized in the discussion.

Board members are on your side and want you to succeed. Let them help you by making the first step.

Making it unnecessary long

Keep things short and focused, and expand over time.

At the Seed stage, board meetings should happen every 12 weeks and should last no more than 1-2 hours. These meetings generally become less frequent and longer over time.

The control syndrome

Be cautious of board members who are trying to make decisions for you. A board member’s job is to help you think through the issues by offering tools or decision frameworks––not to give you all the answers on how to run your business.

In fact, great board members will often refrain from stating opinions. Instead, they ask questions to help flesh out a CEO’s thinking.

The LP reporting

It is important for VCs not to patronize founders and merely show up to gather the necessary statistics for their LP quarterly updates.

So how should you run board meetings instead?

🟢 What to do

Flip the roles

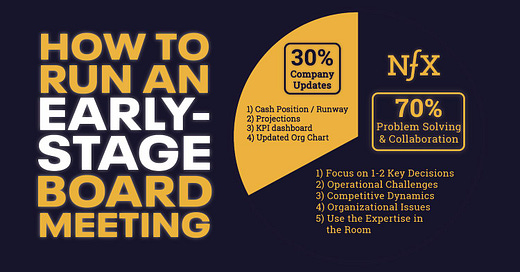

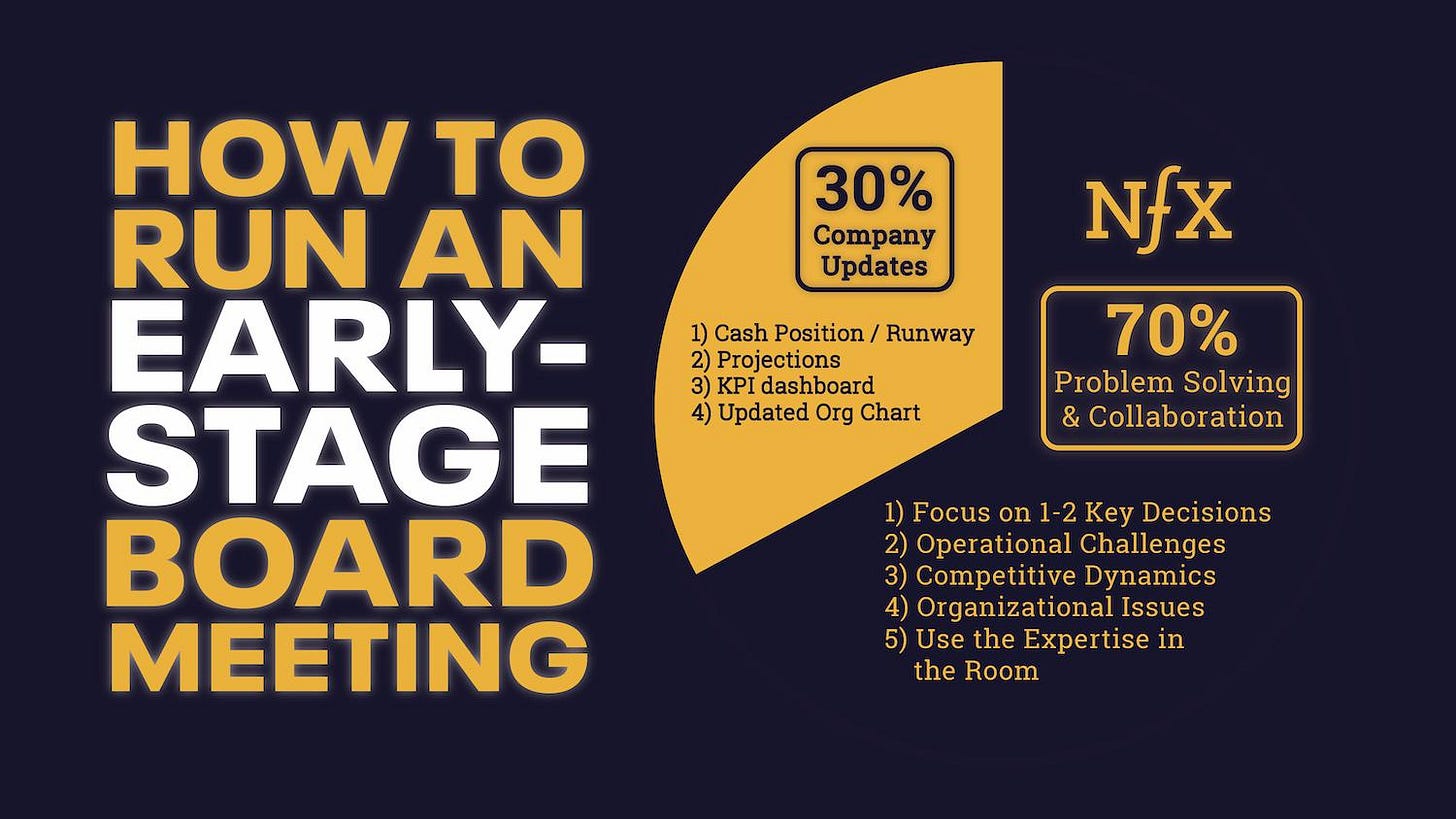

Flip the board meeting. Your role as CEO is not to inform and report, but to engage and gather perspective and move the company forward in the right direction.

Boards are a good thing. They remind you that you are not alone. Your board of directors is dedicated to your company’s success, which means they will challenge you to make better decisions but are on your side as long as you are being ethical and doing the right thing for the company.

The perfect agenda

Highlights / Lowlights (10 mins)

Performance / KPIs (10-20 mins)

Strategic topic or Pain point #1: Internal Conflict, Lack of clarity on Go-To-Market strategy, Sales falling… (30 mins)

Strategic topic or Pain point #2: Engineering Re-org, Strategic Hiring, Discussion around Licensing Contract terms… (30 mins)

Closed Session - 10 mins (Any board matters such as approvals, sensitive topics, and feedback)

The perfect board deck

Highlights / Lowlights - 1 page

Performance / KPIs - 5 pages

Strategic topic 1: 2-5 pages

Strategic topic 2: Engineering Org - 2-5 pages

Closing Session (no slides)

Appendix

Health of the organization (5 slides): Hiring metrics by department, Customer Closing rates, Employee Pulse Survey Results…etc

The perfect Monthly Update

Sending monthly updates helps accomplish three things:

(1) Board members will go above and beyond to help you with your specific asks

(2) The board is better prepared for each board meeting

(3) It is a great way for you as the CEO to take a step back and reflect on the most important elements of your business and objectively measure how well you are doing as a company

Conclusion

Please, fellow VC board members, refrain from requesting financial projections or cash positions. Remember, this is early stage Venture Capital, not Private Equity.

Be more like Steve Jurvetson, legendary VC investor and Tesla board member for 14 years!

Listen to Steve’s mind blowing Tim Ferriss interview and then imagine his impact on a company board meeting 🤯

Yes, Elon revolutionized the auto industry, but board members like Steve are providing immense support behind the scenes (and perhaps even saving Elon from his own impulses at times).

The job as a Board Member is to help early-stage entrepreneurs maximize their chances of realizing their dreams and making a massive positive impact on our society!

Let's help them to the best of our abilities, strategically and operationally, while also providing emotional support to endure this long journey 🎢

Whenever you're ready, there are 2 ways I can help you:

Invest In Climate Tech Like A VC 🎓: Join over 200 students in my cohort-based course to learn how to find unique Climate Tech startups that will change the world, and how to start investing in them regardless of your budget.

Join my Climate investor community 🚀 Unlock access to groundbreaking climate deals. Dive into transformative deals like our recent nuclear fusion venture and two pioneering moonshot projects.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏