Read time: 3 min

If you’re in venture capital, you’ve heard of Internal Rate of Return (IRR).

It’s a big deal.

Wait… but why?

IRR: The Essential Metric

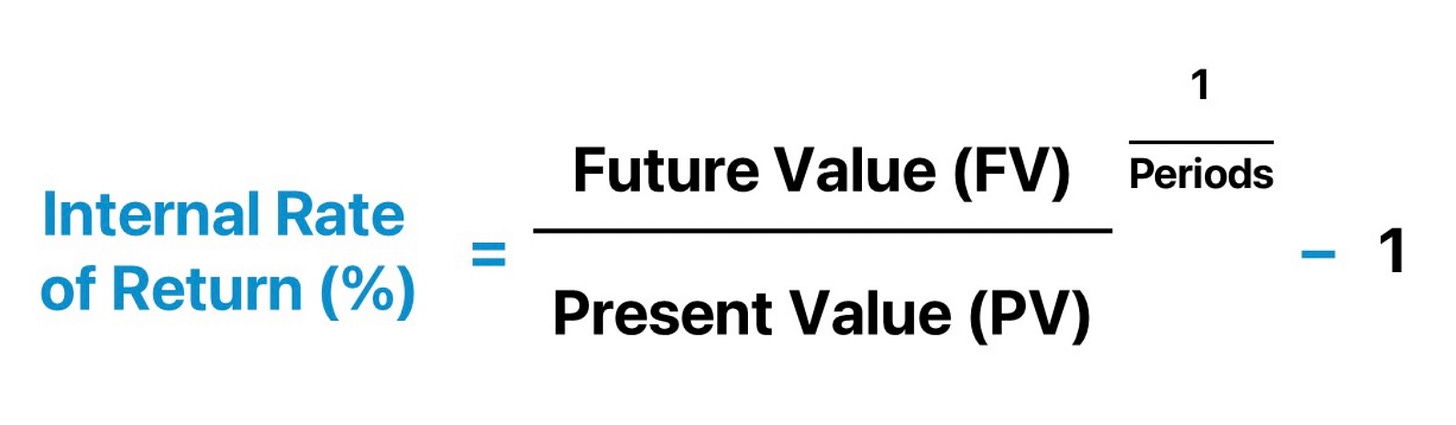

IRR is the annualized percent return a fund or investment has earned—or expects to earn—over time. Unlike other metrics like MOIC (Multiple On Invested Capital), IRR factors in the time value of money.

And that’s huge.

Why?

Because $1 today is worth more than $1 seven years from now. You could invest that dollar now and (hopefully) make more.

In the world of venture capital, where investments are locked up for years, this matters. A lot!

Why IRR Rules Venture Capital

Venture capitalists (GPs) measure performance across funds and vintage years using IRR.

The benchmark lets them compare their high-risk startup bets to other investments, like stocks (7-10%) or real estate (8-12%).

Here’s the kicker: Two funds can both return 10x, but if one does it in seven years and the other in fourteen, the first has a much higher IRR. Faster returns mean a better-performing fund.

What’s a Good IRR?

In seed-stage investments, GPs target an IRR of 30%.

Later stages? Aim for 20%.

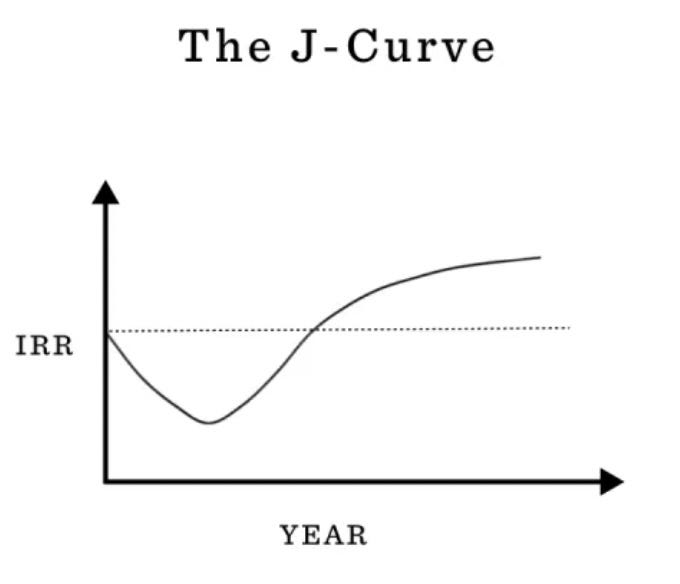

But remember—this is venture capital, where volatility reigns. It generally follows a J-Curve.

IRR vs. TVPI

Total Value to Paid-In (TVPI) is another metric, measuring total value (realized and unrealized) against the capital invested. TVPI doesn’t care about timing, but IRR does.

A TVPI of 1.25x could mean a 25% return, but IRR tells you how quickly that return was achieved. Time matters. So, for comparing funds with different timelines, IRR is the metric you want.

The Bottom Line

IRR isn’t perfect. Timing and unpredictable startup valuations can mess with the numbers, but it’s still the go-to metric for GPs who want a clear picture of their fund’s performance.

AngelList created a calculator that blends IRR and TVPI to give you a comprehensive view. Want to know how your fund stacks up?

Try it out: VC Fund Performance calculator

Conclusion

LPs might nod along to those feel-good metrics—reduced travel emissions, diversity initiatives, and sustainability efforts.

But they’re not what matters.

In the end, it’s all about returns.

LPs will judge you by one thing: how much money you make for them 💰

The extra stuff is nice, but without solid financial performance, ciao bambino!

Want to join our Climate Investors community?

👉 Join the Climate Insiders investor community 🚀 Whether you are looking for unique deal flow, wanting to develop your Angel track, or simply seeking exposure to the best projects in the space, join us here.

🌟Oh, by the way, great news—it’s back! After a year-long break and with over 260 people on the waitlist, my online course Invest in Climate Tech like a VC is returning on October 5-6 📆. You’ll get hands-on experience to invest like a pro with real-world case studies. I have 5 spots left and would love to have you! Sign up here 👉 Invest in Climate Tech like a VC