Read time: 3 min

🌟 Exciting news—it's back! My cohort-based course Invest in Climate Tech like a VC returns on October 5-6 📆. Gain hands-on experience in investing like world-class Climate VCs. I'd be thrilled to have you join! Best part? It's 100% reimbursable by your fund or employer.

Offtake agreements.

Think of these as the ARR of climate tech—the ultimate proof that your hardware isn’t just cool, but actually wanted by the market.

Why They Matter

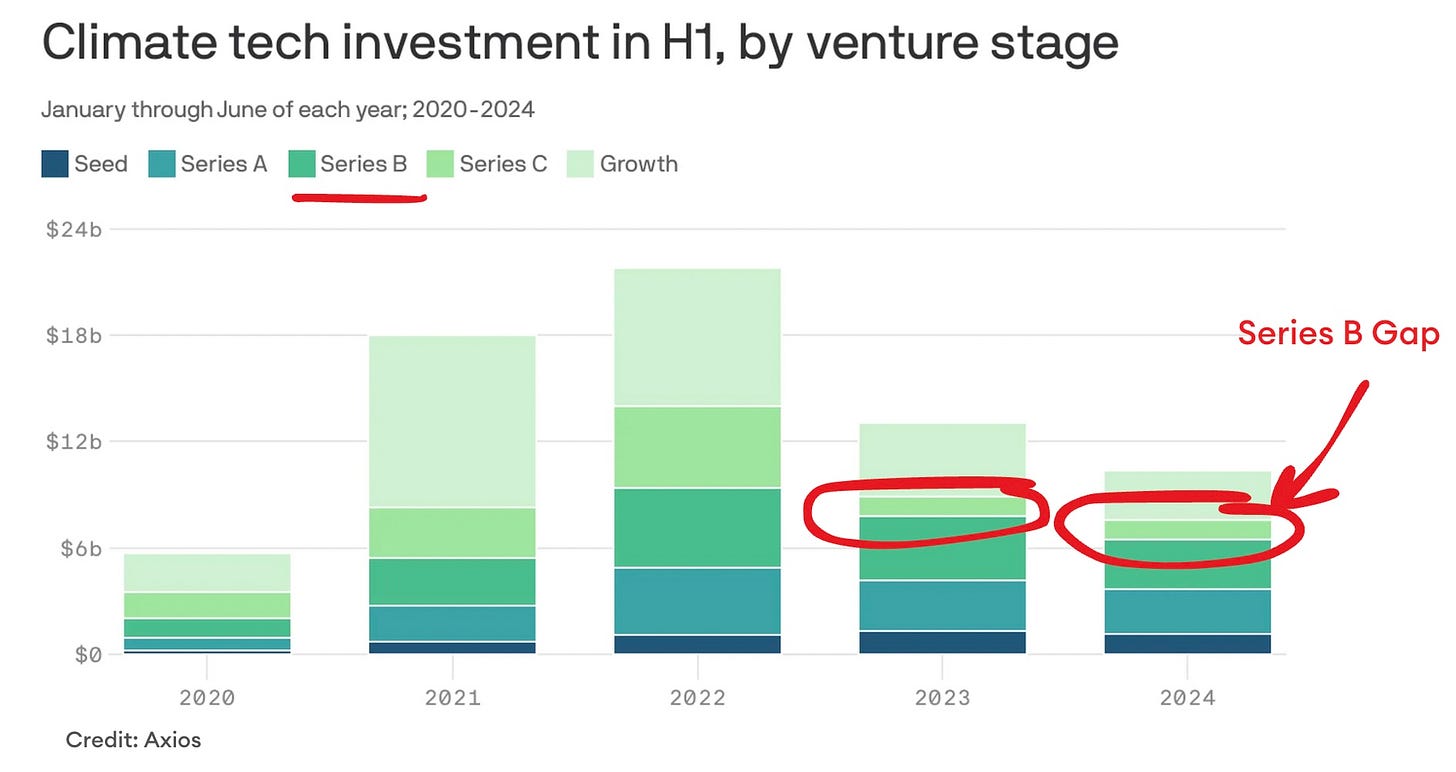

You’re a climate tech founder eyeing Series B. You’ve got the tech. The vision. But guess what?

That’s not enough.

Investors don’t want just another prototype—they want proof people will pay. The real deal. It’s like betting on a SaaS startup without ARR. No one does that.

That’s where offtake agreements come in.

The Difference Between Making It... and Not

Look at H2 Green Steel.

Before they even delivered low-carbon steel, they locked down €4.2 billion from investors.

How?

Offtake agreements.

Big names— IKEA, Mercedes-Benz, Scania—signed up to buy greener steel before it even hit production. Those agreements were their golden ticket. Proof that the market needed what they were building.

Proof that they weren’t just making some niche tech—they were changing supply chains.

That’s how you bridge the so-called “Series B Gap” in climate tech.

Celebrating Offtake Milestones

Startups are now celebrating Offtake Agreements like they celebrate Fundraising milestones.

And it’s a good thing.

It shows that traction is picking up, and the impact is real.

Remember, we’re talking hardware here. Infrastructure and FOAK projects that are high-stakes and high-cost.

This industry isn’t just selling an idea—we’re building something real, something that takes serious capital.

Traditionally, Growth investors had an appetite, but now?

They want to see future offtakes lined up. These deals give them the confidence to bring in bigger funds—asset managers, infrastructure investors, and banks.

How to Secure Offtake Agreements

So how do you lock these down?

1. Start Early.

Like, day one early. Start talking to potential offtakers before your tech is even fully baked.

2. Do Your Homework.

Find the first movers (Corporates, Institutions). Read their sustainability reports. Know what they need to hit their green goals, and position your tech as the answer.

It’s a hustle. But it’s worth it.

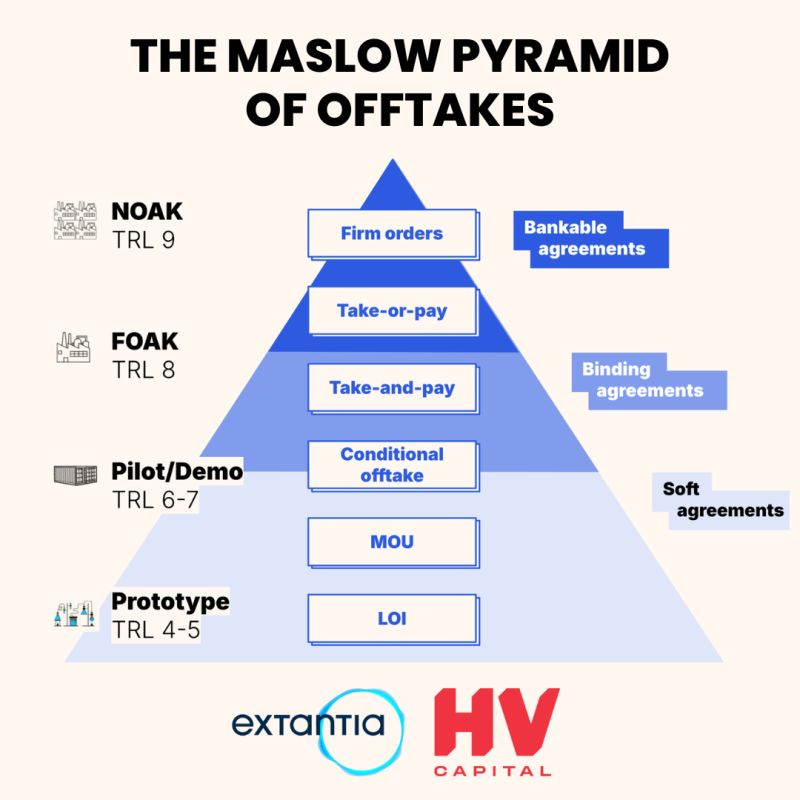

The Offtake Pyramid

Not all offtakes are created equal.

Different stages demand different levels of commitment, maturity and certainty.

Thanks Extantia and HV for creating the Maslow Pyramid of Offtakes:

Soft Agreements (Prototype Stage - TRL 4-5)

Non-binding deals like LOIs and MOUs. They’re low risk but show feasibility.

Binding Agreements (Pilot/Demo Stage - TRL 6-7)

Short-term contracts tied to milestones. Now you’re proving performance and reliability.

Bankable Agreements (FOAK/NOAK Stage - TRL 8-9)

Long-term deals. These are the holy grail—cash flow certainty and major investor confidence.

Are you still confused about FOAK and NOAK?

We cover the topic in great length with Yair Reem (Extantia) on the podcast 🎙

How VCs Can Help

VCs can play a huge role here.

By creating roles like ‘Head of Offtakes and Partnerships,’ they can help founders navigate these agreements and open doors to industries ready for green solutions.

Final Take

It’s critical to demystify these nebulous concepts.

Offtake agreements are more than just contracts—they’re building bridges to offtaker industries that need to evolve. Fast.

In ten years, we’ll look back and see these deals as the pivotal moments that pushed climate tech forward.

Kudos to the founders hustling to secure them, and the funds stepping up to help this space creatively mature.

This is how we change the game.

Additional resources:

Want to invest in top Climate Tech startups with us?

🔫 Our Climate Insiders community is pulling the trigger on a unique UK deal this week: top-tier lead investors, a ginormous market, and exceptional founders with impressive traction. No kidding. I don’t come across this trifecta often.

Interested in learning more about this opportunity? Let's schedule a 15min call: