SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

SAFE Notes Can Wreck Your Equity. Here’s How to Stay in Control

Read Time: 6 min

Raising money is exciting. Until you realize how much of your company you just gave away.

SAFE (Simple Agreement for Future Equity) notes make fundraising easy, but they also make dilution a silent killer.

Too many founders don’t run the numbers before signing, only to wake up post-Series A wondering how they lost half their company.

Once equity is gone, it’s gone.

Let’s make sure that doesn’t happen to you.

How SAFE Notes Dilute You Without You Noticing

Every round of funding = less ownership for founders. That’s normal.

The key is growing the pie so your smaller slice is worth way more.

But here’s the problem:

SAFE notes delay dilution instead of pricing it upfront. Founders raise multiple SAFEs, thinking they’re buying time—only to wake up later and realize they’ve handed out huge chunks of equity at a discount.

If you don’t model the dilution early, you’re flying blind.

SAFE Notes: What You Need to Know

Before raising a priced round, many startups raise capital via SAFE notes. They delay setting a valuation—but dilution is inevitable once these convert.

And the reality?

SAFE investors often get better terms than future investors.

Two mechanisms determine how much equity you give away:

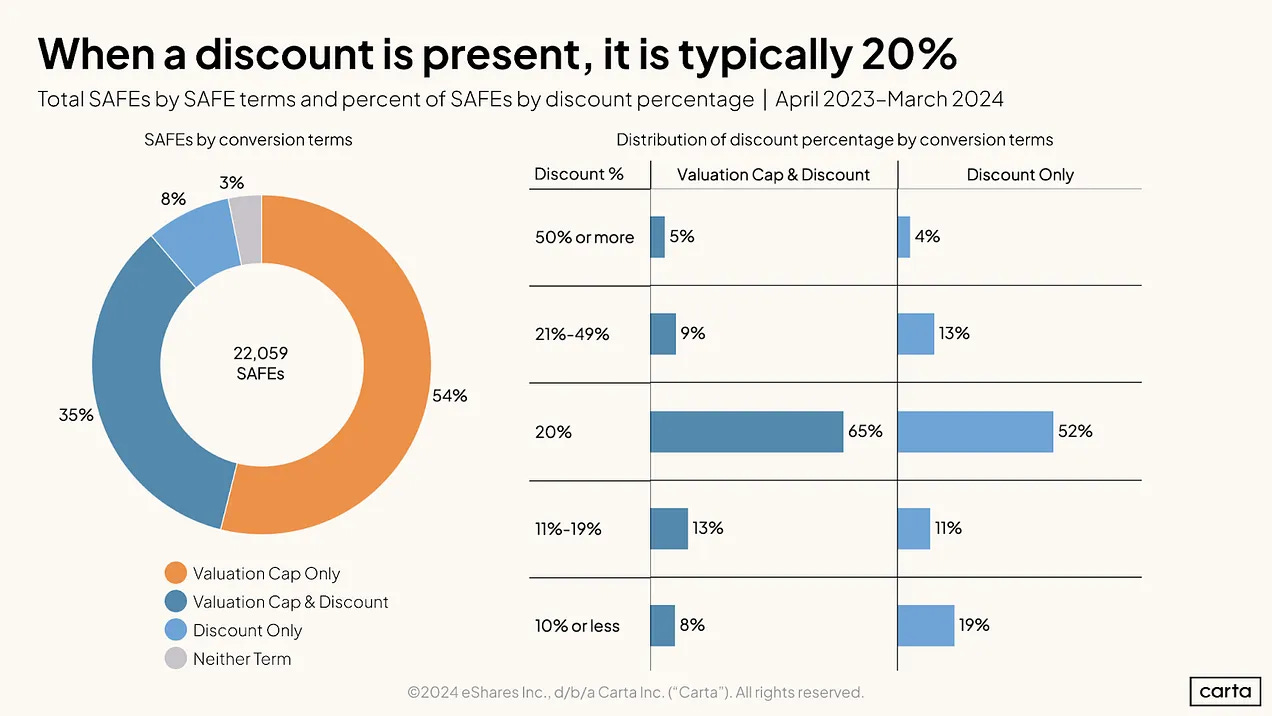

1. Discounts—The Hidden Dilution Bomb

SAFE notes often include a discount that lets early investors convert their investment into shares at a lower price than new investors in your next round.

📌 Example:

You raise a SAFE with a 20% discount

Your next round is at a $10M valuation

SAFE investors convert as if the valuation were $8M

They get way more shares per dollar than new investors

🔹 Founder Reality Check: A 20% discount might sound harmless, but if you don’t model dilution in advance, you could be in for a shock.

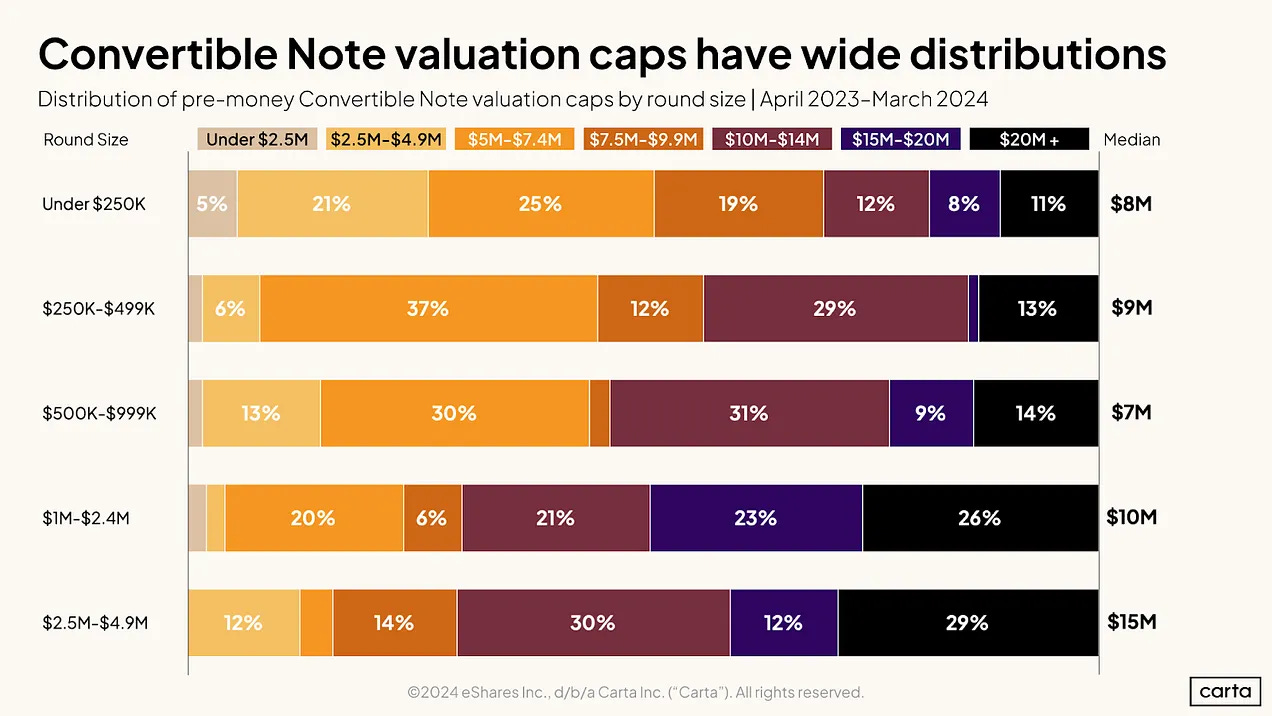

2. Valuation Caps—Early Investors' Golden Ticket

A valuation cap locks in the maximum price at which a SAFE converts.

📌 Example:

You raise a SAFE with a $5M cap

Your next round is at a $10M valuation

SAFE investors still convert at $5M, getting twice as many shares as new investors

🔹 Founder Reality Check: Valuation caps sound founder-friendly, but if your cap is way too low, you’re giving away equity on the cheap.

The Big Problem: Pre-Money vs. Post-Money SAFEs

If you thought that was confusing, here’s where it gets messy.

There are two types of valuation caps:

1️⃣ Pre-Money Caps (Old Model)

The cap applies before new investments, so dilution can be unpredictable.

You won’t know exactly how much equity you’re giving up until later.

2️⃣ Post-Money Caps (New Standard)

The cap includes all convertible instruments, so dilution is set in stone.

VCs love this because it gives them clarity—but founders end up with less ownership than they expect.

📌 Founder Tip: Since Y Combinator updated its SAFEs in 2018, most use post-money caps. If you’re raising SAFEs, understand the difference before signing anything.

How to Protect Your Equity Like a Pro

🔹 Step 1: Model Your Dilution

Most founders don’t see dilution coming until it’s too late.

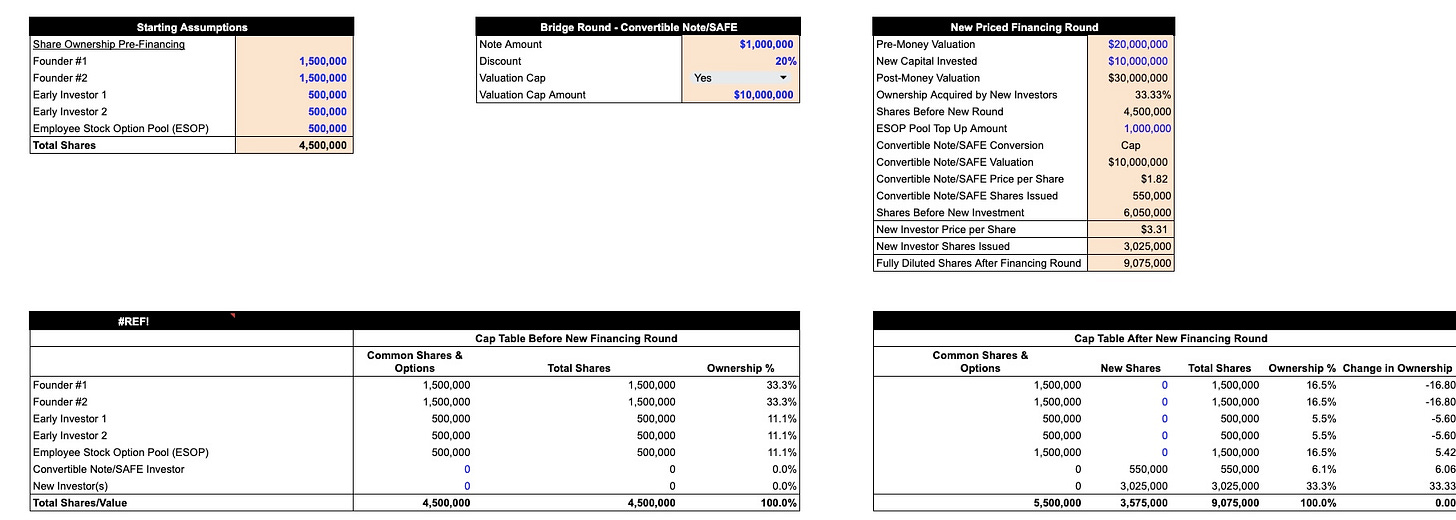

Here is a free cap table template to simulate different funding scenarios.

✅ Plug in your discounts, caps, and SAFE amounts

✅ See exactly how much equity you’re giving away

✅ Avoid dilution surprises in future rounds

🔗 Get the Cap Table Template Here (🚨 Just Make a Copy)

🔹 Step 2: Choose the Right SAFE Terms

If you’re raising again soon:

→ A valuation cap is fine since you have visibility on growth.

If your next round is uncertain:

→ A discount-only SAFE prevents you from getting burned if your valuation jumps unexpectedly.

If you must raise with both:

→ Model dilution carefully to avoid crippling your cap table.

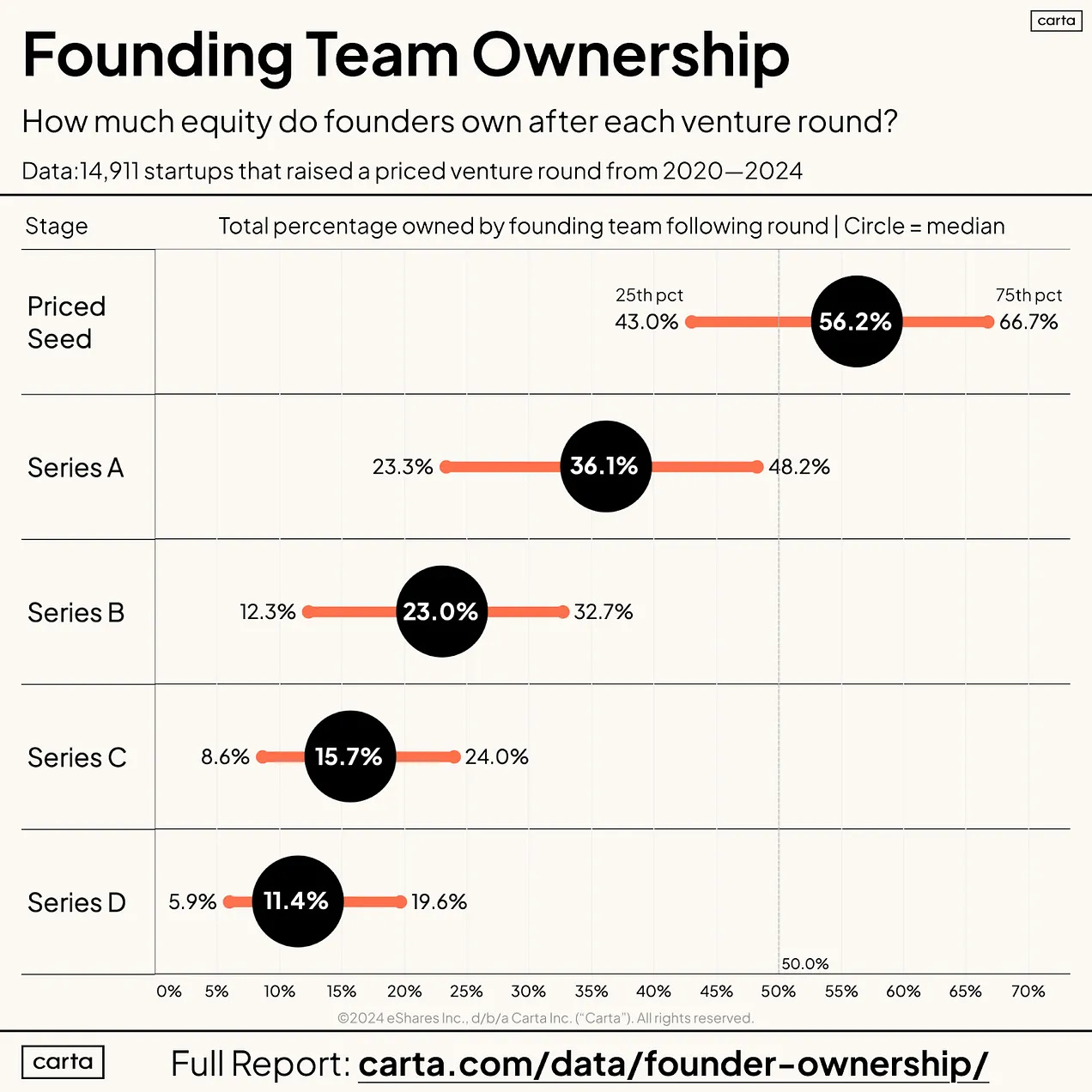

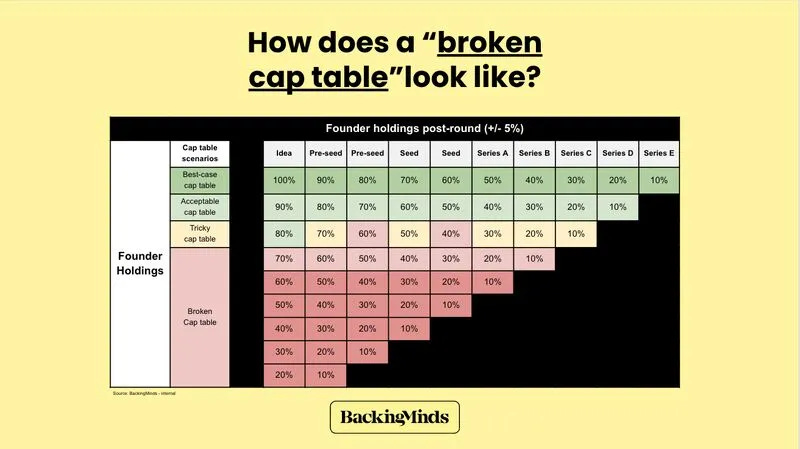

🔹 Step 3: Know What VCs Look For

When institutional VCs evaluate startups, they always check for:

✔️ Founder Ownership – Will you stay motivated?

✔️ Cap Table Clarity – Are there too many SAFEs cluttering the structure?

✔️ Investor Alignment – Are previous investors getting too much upside?

Too much early dilution = fundraising gets 10x harder.

Final Take: Fundraising Is a Long Game—Play It Smart

SAFEs can be a founder-friendly way to raise capital, but only if you understand the trade-offs.

Here’s how to stay in control:

✔️ Pre-plan dilution before signing anything

✔️ Structure deals wisely to avoid over-dilution

✔️ Negotiate terms that keep you in the driver’s seat

Too many startups fail not because they can’t raise money, but because they raise money the wrong way.

Get the Full Toolkit for Smarter Fundraising

The cap table template is just the start.

As a premium subscriber, you’ll get access to:

✅ The Ultimate Investor List (+12,000 VCs & Angels)

✅ 40 Seed Decks That Raised $500M+

✅ The Only Finance Tracker Your Startup Needs

✅ The Ultimate Notion Data Room Template

Love the stats. Thanks for putting dilution risk in evidence. Not spoken enough in startup world

Super helpful!