📣 4min to build your Due Diligence Checklist and save months of unnecessary DD 📆

You can refer your friends to this newsletter and earn a FREE seat in my Climate Tech investing course. See the support leaderboard here.

Here’s the scoop: Investment decisions? They’re typically made in a snap, in the first call or during those initial, buzzing conversations.

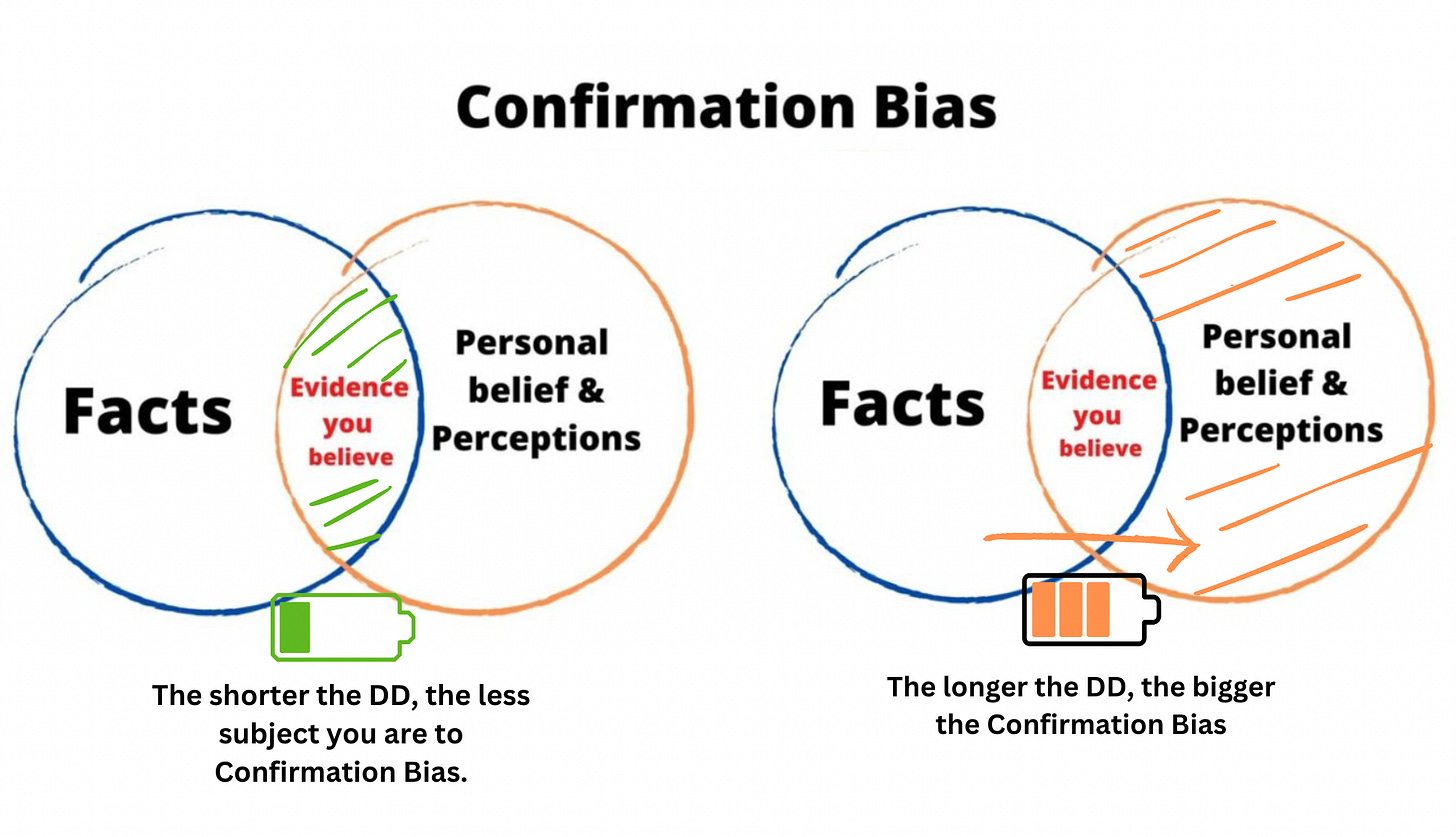

This quick-fire decision-making can be a bit of a double-edged sword. The longer we mull over decisions, the more we tend to lean into our confirmation biases. We start seeking out info that aligns with our initial thoughts rather than challenging them.

It puts a spotlight on the importance of those first meetings. Asking the right questions is crucial to paint a true picture of the business from the get-go.

Here is a list of 10 questions that I ask on EVERY pitch call, which are the primary factor in 80% of my investment decisions.

🔬 Let’s Talk Technology & Innovation:

So, what makes your technology stand out?

Tell me about those unique selling points!

How feasible is your technology, and how are you protecting it?

Walk me through your technical feasibility and IP protection strategies.

🌐 Diving into Market & Business Strategies:

What's the size of the market you’re targeting and how do you plan to capture it?

Give me the lowdown on your addressable market and capture strategies!

Scaling is key! How do you plan to grow, and what hurdles are you foreseeing?

Share your thoughts on your scaling strategies and potential barriers.

👥 Getting to Know the Team & Operations:

Can I get some insights into your team’s background and how it aligns with the project?

I’d love to hear more about your team’s experiences and relevance.

How do you envision managing the operational and financial sides as you expand?

Share your game plan for handling the operational and financial dynamics!

🌿 Impact & Sustainability: Let’s Get Green!

Can you quantify the environmental impact of your technology?

I’m keen to hear about the potential CO2 reduction impact!

How are you ensuring your product is sustainable throughout its life cycle?

Let’s talk sustainability and lifecycle assessment.

🔍 A Few More Things:

How much funding are you seeking, and what are your key success metrics?

Let’s dive into your funding allocation and success metrics.

What’s the valuation?

Tell me that your valuation is between $5-12m at Pre-seed, $10-25m at Seed, or I’m out! 😄 (BONUS: $20-50m at Series A)

Conclusion

Finding those climate tech gems begins with kickstarting the conversation right. The blend of technology insight, market understanding, team dynamics, and sustainable vision is crucial from the get-go, as statistics suggest that the game is pretty much set after those initial impressions are formed 📊

Here’s the key: both founders and investors need to step into those first meetings with their A-game. It’s about diving deep from the start, asking insightful questions, and understanding the venture's real potential and challenges. This approach doesn’t just drive better, more informed decisions—it’s a time-saver, helping us avoid lengthy and cumbersome due diligence processes later on.

Whenever you're ready, there are 2 ways I can help you:

Invest In Climate Tech Like A VC 🎓: Join over 200 students in my cohort-based course to learn how to find unique Climate Tech startups that will change the world, and how to start investing in them regardless of your budget.

Join my Climate investor community 🚀 Unlock access to groundbreaking climate deals. Dive into transformative deals like our recent nuclear fusion venture and two pioneering moonshot projects.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏