Read time: 4min

Have you ever wondered what sets apart the mega-successful startup investors?

I'm talking about those who have achieved 50, 100, or even 1000 times returns! The elite 🏆

I think it's safe to say they have discovered some “secrets” of equity investing.

Interestingly, there is a striking parallel between elite investors 💰 and elite athletes 🏀.

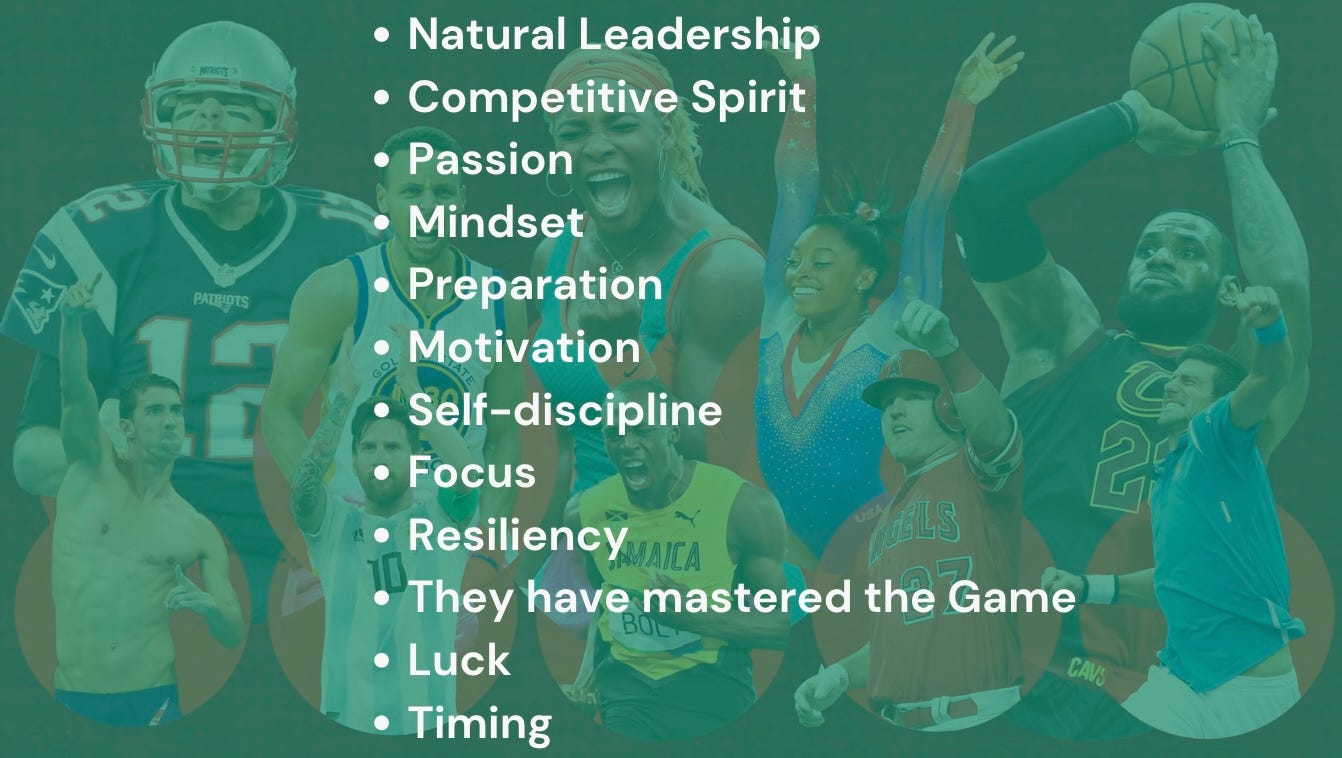

What do Elite Athletes all have in common?

Regardless of their sport or the time period they lived in, they all exhibit the following traits:

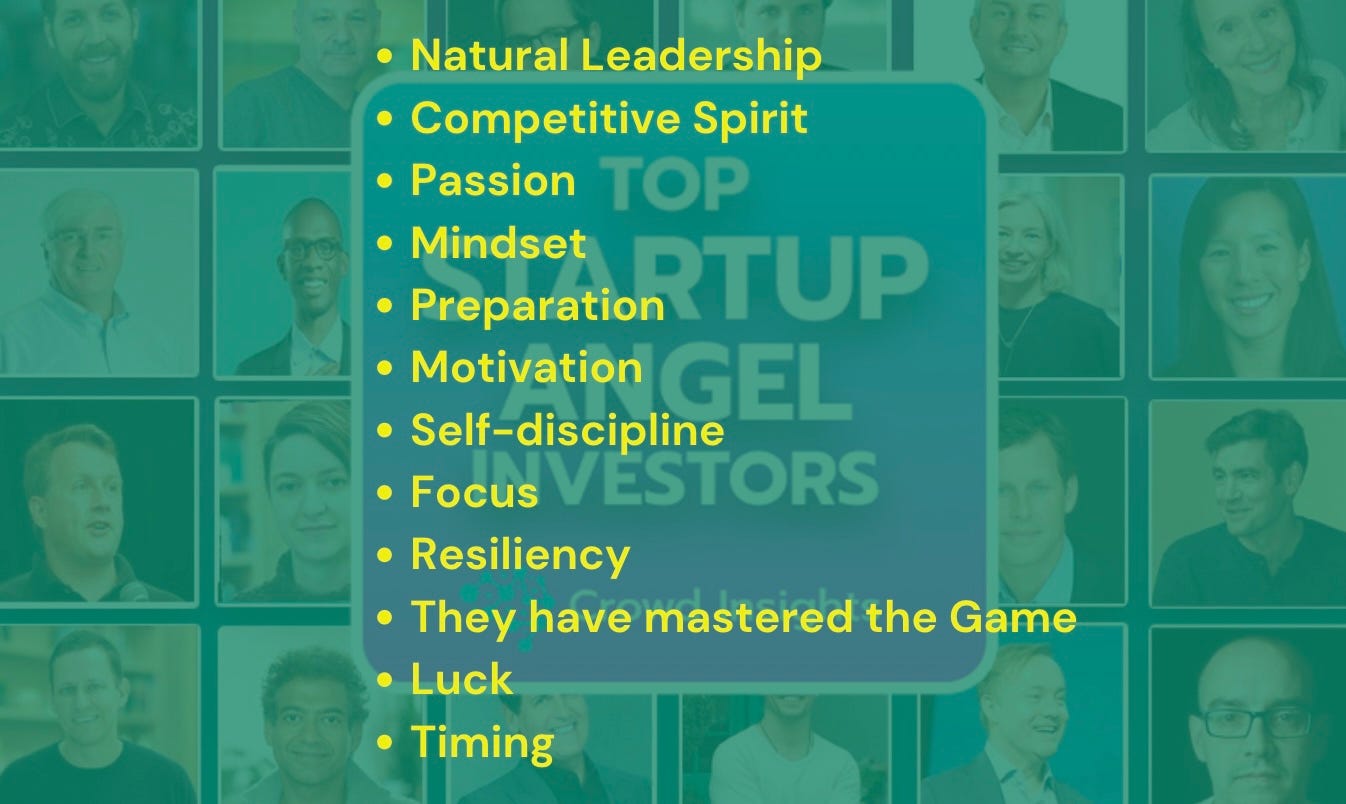

So, what do Elite Investors have in common?

Guess what, the elite investors ALSO exhibit the exact same traits:

The overlap is insanely accurate.

Beyond cultivating those skills, I've found 4 rules that come back over and over again when you listen or read from the crème de la crème in startup-investment land.

Let’s uncover those 4 simple rules.

1. Back the Jockey, Not the Horse

Elite investors swear by this mantra. It's not just about the idea, it's about the person behind it. They invest in founders with a track record of resilience, passion, and an unwavering commitment to their mission.

2. Obsess over the Outliers

Elite investors seek out individuals they refer to as "obsessives".

What exactly are obsessives?

I've found that Kobe Bryant has a remarkably accurate definition of obsessives.

Speaking of obsessives, he famously engaged in what he called "666" workouts, where he would work out for 6 months, 6 days a week, for 6 hours a day 👀

The founders that are obsessed with outliers who defy norms, challenge conventions, and rewrite the rules of the game.

3. Watch out for the 'Steve Jobs' moments

Elite investors invest in founders who can effectively communicate their vision for the future in a compelling and convincing manner.

They have these 'Steve Jobs' moments💡

Okay, there are countless videos of Steve Jobs.

But man, watch this clip. You have to give the guy credit for his incredibly accurate predictions.

There is no doubt in his mind. He has traveled back from the future to tell you how things will unfold.

4. Prompt their Crystal Vision

That one overlaps with #3. But I can’t emphasize this one enough.

Elite investors seek founders who can articulate their vision with crystal clarity. It's not just about talking, it's about painting a landscape that others can see and believe in.

This breed of founders detect mega-trends before the crowd, foresee the future, and share it with enormous conviction. It becomes hard not to believe them.

Conclusion

Yes, founders and startups deliver on the job. They bring their vision to reality and work extremely hard to make it happen.

However, elite investors also deserve credit. They are the architects of the future.

They don't just invest in companies, they invest in movements that shape our world.

All the digital experiences that dominate our world today, such as payment systems, taxi apps, gaming platforms, Zoom calls, and food delivery services, have been backed by incredibly bold investors.

The only hiccup? Technology is neutral, and it's unclear whether those digital innovations truly lead to a net-positive impact. They save us time, but do they really contribute to overall happiness? 🫤

On the other hand, in our upcoming era, Climate Tech startups (particularly in Hardware) play a crucial role as the architects of our real-world future.

That requires a new wave of visionary investors shaping tomorrow's positive trends and supporting the bold ideas who are truly daring for a significantly better world.

Stay visionary, stay daring, and until next time!

Want to gain exposure to the best Climate Tech deals?

👉 Join the Climate Insiders investor community 🚀 Together, we are investing in fantastic early-stage Moonshot Climate deals. Whether you are looking for unique deal flow, wanting to develop your Angel track, or simply seeking exposure to the best projects in the space, fill out this form to join the community.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏