The Cap Table Catastrophes: Avoid These Pitfalls to Secure Climate Tech Success

💡 Insider Secrets and Expert Advice for Founders Crafting their Cap Tables 🚀

Each Saturday, I send out 1 actionable tip to support the growth of your Climate Tech startup, your fund, or career.

Today’s post can be read in 5 min.

🤗 Welcome to the 13 new followers since last Saturday! If you haven’t subscribed yet, join us:

As a founder, your cap table is one of the most critical documents you will have. It outlines the ownership structure of your company and who has what percentage of equity. However, it's all too easy to make mistakes that can have long-lasting consequences.

Our friends at Extantia prompted this week an important debate:

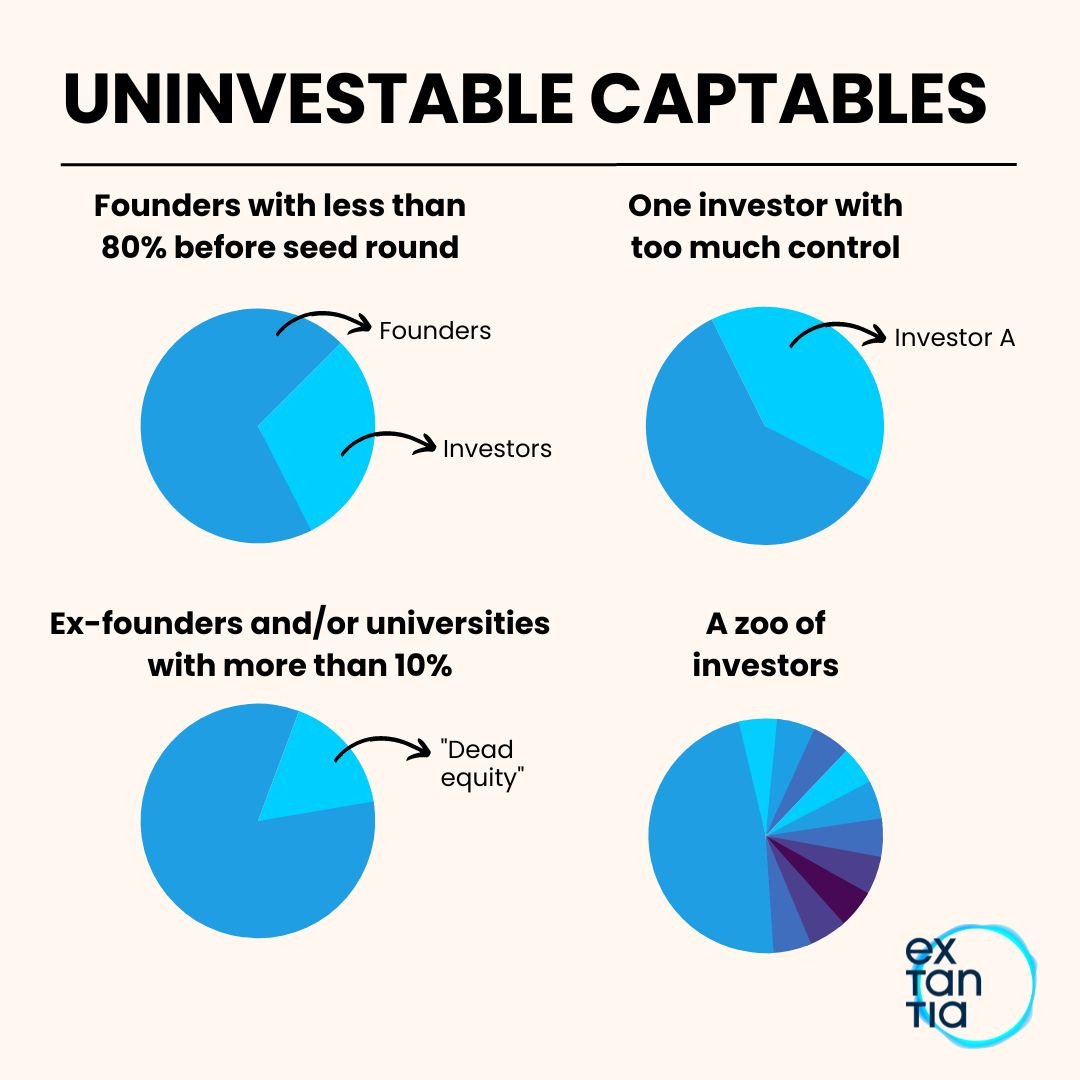

What are the uninvestable cap tables?

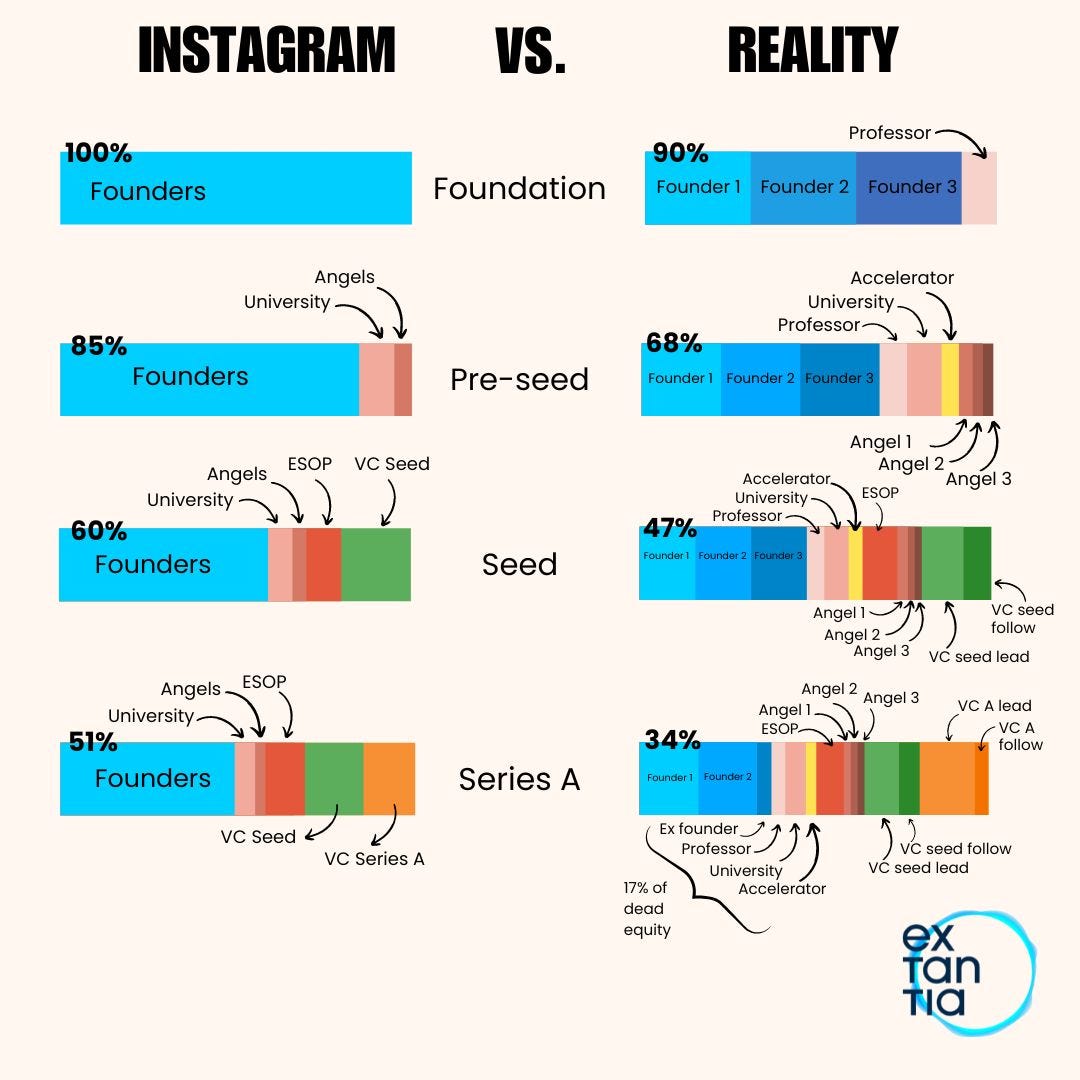

What’s instagram vs reality as you go through subsequent rounds of funding?

As an extension, I want to contribute five key tips to Climate Tech entrepreneurs on what NOT to do with your cap table as founders.

1-Don't Delay Defining Ownership

Picture this: You and your co-founders are super excited about your Climate Tech startup. You're experimenting away, attending meetings, and fundraising. But amidst the chaos, you forget to define ownership percentages. As time goes by, conflicts arise, and discussions around equity allocation become challenging. Avoid this nightmare by establishing clear ownership percentages from the start.

Example: Yours truly 🙋 I started my first company with 2 co-founders who were equally enthusiastic. However, we neglected to clarify ownership stakes. Months later, when an investor showed interest, disagreements erupted, jeopardizing the partnership and delaying funding

A straightforward founders' agreement will save you from potential disagreements later.

Need examples?

2-Don't Underestimate Future Hiring

You're passionate about your vision, and as your Climate Tech startup grows, you'll need to bring talented individuals onboard.

But be cautious not to allocate excessive equity early on. Reserve ample equity for future hiring through an ESOP program to attract top-notch talent and motivate them for long-term success. Adjusting your cap table every time you hire can be a tedious and time-consuming process.

A 10-15% ESOP pool is standard these days at Seed/Series A stage.

Example: Renewable Energy Solutions Inc. allocated all the equity to the founding team, leaving no room for future hires. As a result, they struggled to attract skilled engineers and had to restructure their entire ownership to get investors onboard.

Resources:

3-Don't Forget About Vesting Schedules

Vesting schedules are the best tool to ensure commitment and alignment among founders and employees.

Omitting vesting schedules can lead to demotivated teams or founders departing with a significant share. The standard is four years with a one-year cliff. Don’t reinvent the wheel.

Example: EcoTech Innovations had a promising team, but they neglected to implement a vesting schedule. Unfortunately, one founder left the company after a year, taking a substantial portion of equity, which turned off the majority of investors.

Resources:

4-Don't Give Away Control Too Early

When attracting early investors, particularly angels and early-stage funds, it is important to avoid granting control or special rights. While capital is vital, it is equally important to maintain control over your company's direction and decision-making.

In a down market, investors may have more leverage and may require you to grant excessive control rights, such as preferred shares, dilution rights, or exotic provisions. It is okay to negotiate and push back.

Example: CleanAir Technologies eagerly sought investment to scale up their operations. However, in their haste, they gave away a significant chunk of equity to an investor who ended up imposing strict conditions and swaying the company's direction away from its core values.

Resources:

5-Don't Overcomplicate the Structure

Keep your cap table structure simple and straightforward. Avoid complex financial instruments or convoluted ownership agreements that may confuse future investors or complicate future rounds of funding. Simplicity ensures transparency and enables smooth negotiations.

Example: ClimateTech Solutions developed a cap table with complex convertible notes and preferred equity rounds. When the time came for subsequent financing, potential investors found the structure impossible to decipher, which led to declines.

Resources:

CONCLUSION

The best entrepreneurs approach cap table management with caution and strategic foresight.

Avoid the common pitfalls that kill most startups.

It's important to survive before you can thrive 🌳

That's all for this Saturday. Simple insights in 5 minutes.

What do you think about my weekly Newsletter? Love it | It's great | Good | Okay-ish | Stop it

If you have any suggestions, want me to feature a topic in the newsletter or a guest in the podcast, hit me up! Just respond to this email, I respond to every email.

And if you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏