Hey 👋 - Yoann here.

Each Saturday, I send out 1 actionable tip to support the growth of your Climate Tech startup, your fund, or your career.

It can be read in less than 5 min.

Enjoy!

👋 Hi to the 52 new readers since the last post! If you haven’t subscribed yet, join us:

Startups and VC funds do not follow a normal distribution, they follow a Power Law curve.

As a reminder, a power law curve is when the distribution of returns is heavily skewed. Or simply put, a small % of events generate a large % of results.

“The greatest shortcoming of the human race is our inability to understand the exponential function”, old quote by the physicist Albert Bartlett

By now, it has become common knowledge that most entrepreneurs and investors have heard of the concept of the Power Law.

However, very few TRULY UNDERSTAND its profound implications on fundraising, investing, portfolio management, and time management.

This is because humans have a hard time grasping exponential curves.

To illustrate the concept, let's look at examples from other mainstream industries that are governed by the Power Law.

After researching publicly available studies, I found that the same pattern emerges EVERYWHERE:

The Top 1% Fiction Books make up 90% NY Times Bestsellers

The Top 1% Movies drive 90% of Box Office

The Top 1% Video Games generate 90% of sales

Top 1% of Musicians produce 90% of listens

…. the list goes on and on.

Looking at these graphs, the same question arises - what is it that success obeys such a level of concentration?

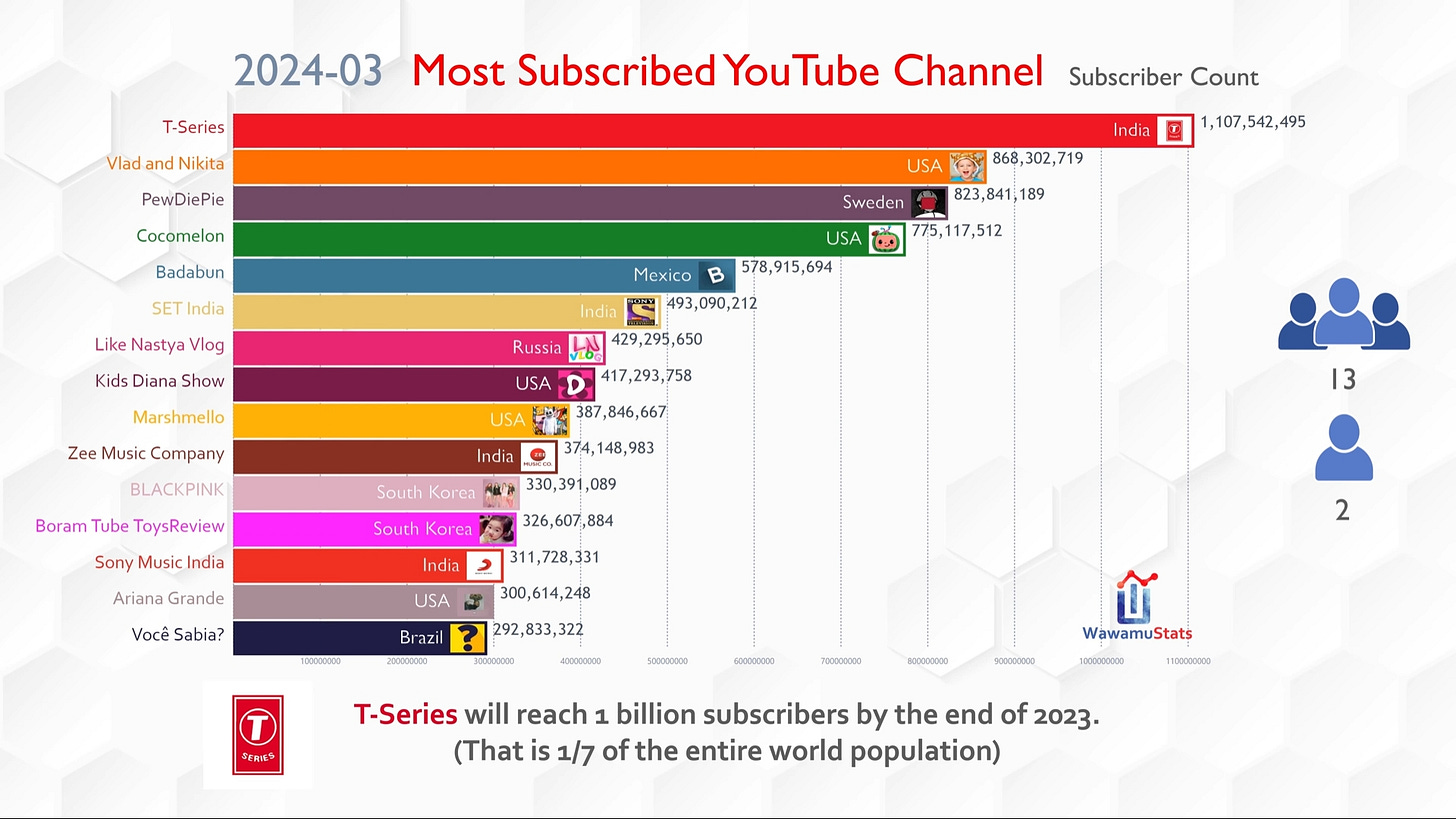

I mean, look, it also applies to YouTube:

Wealth distribution (which is even accentuating over time):

And even to the words we use in our day-to-day lives!

The point is: The power law rules everything!

So why does it matter to us climate entrepreneurs and investors?

Both Startups and VC funds also follow a power law curve:

A small % of startups will accrue the majority of VC money

And a small % of portfolio investments will yield the majority of VC funds returns.

“The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.” - Peter Thiel

And what does all of this mean ?

Most of the investments don't return any money at all - in fact, most of them actually lose money.

But it DOES NOT MATTER.

Because the "hyper performers" make up for all of those losses. These are the companies that really bring in the big bucks.

Basically, this means that the chances of something really wild happening are higher than you might think. In the end, the portfolio is built around the idea that these unlikely, yet totally awesome, outcomes will bring in the big returns.

This implies one rule for VCs:

Only invest in companies that have the potential to return the value of the entire fund.

So what single metric should we be looking at ?

VCs are in pursuit of investments that will yield massive returns.

Generally speaking, this conversation starts and ends with the Total Addressable Market (TAM). Without a compelling market, a company is capped by the returns they can generate.

This does not mean that the market has to be big now, but has the chance to develop into a major market (check out this example on Uber’s TAM). Check out this free guide for modeling your TAM here.

CONCLUSION

The bigger and more challenging the problem you're trying to solve, the greater the pent-up demand for your solution, and the larger your total addressable market.

By investing only in companies with enormous TAM, you increase your odds of hitting a jackpot and obeying the Power Law, regardless of all other metrics.

In the climate world, many people focus on finding the single company that will become the “carbon reduction jackpot” and help alleviate climate change.

However, it is more likely that a first-wave company will invent a set of tools or technologies that will be iterated upon by a second wave, and only a group of third-wave companies, copycats, or regional “twists” will translate this step change into a massively transformative innovation with planetary repercussions.

I call this the "Power Law of Impact." True and long-lasting impact is initiated at the start by a handful of companies that take enormous risks to explore unexplored territories and demonstrate the feasibility of a revolutionary innovation.

As impact-driven entrepreneurs and investors, it is our responsibility to consider the Power Law of Impact in our activities and not obsess over immediate financial returns.

Research shows that the more impactful and transformative a company is for society, the more financial gains it will accrue over time.

IN CASE YOU MISSED OUR LAST 2 PODCAST EPISODES

Entocycle - Turning insects into protein to ensure global food security (ft. Keiran Whitaker)

Highly recommended. This episode will bring you up to speed on everything Insect Farming.

Top Tier Impact - The Surprising Solution to Climate Change: Rebuilding Communities (ft.Alessa Berg)

Alessa has built an impressive impact community in just 4 years. We touched on the crucial role that communities and spiritual awakening have to play to give us a chance to solve humanity's biggest challenges.

That's all for this Saturday. Simple insights in 5 minutes.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or share it with others on LinkedIn or Twitter.

Cheers,

Yoann

Made with Climate 💚

![Zipf's Law and My Blog on Language [OC] : r/dataisbeautiful Zipf's Law and My Blog on Language [OC] : r/dataisbeautiful](https://substackcdn.com/image/fetch/$s_!fQQ5!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbfc93c68-8a4c-46a9-b793-ae5bf0b9bd67_1136x489.jpeg)