📣 5min to reveal ALL THE TOOLS you need to run a Climate VC.

You are now 1,533 readers! 🔥🚀 You can refer your friends to this newsletter and earn a FREE seat in my Climate Tech investing course. See the leaderboard here.

Investors have a lot to manage, from sourcing potential investments to handling current ones, and everything in between.

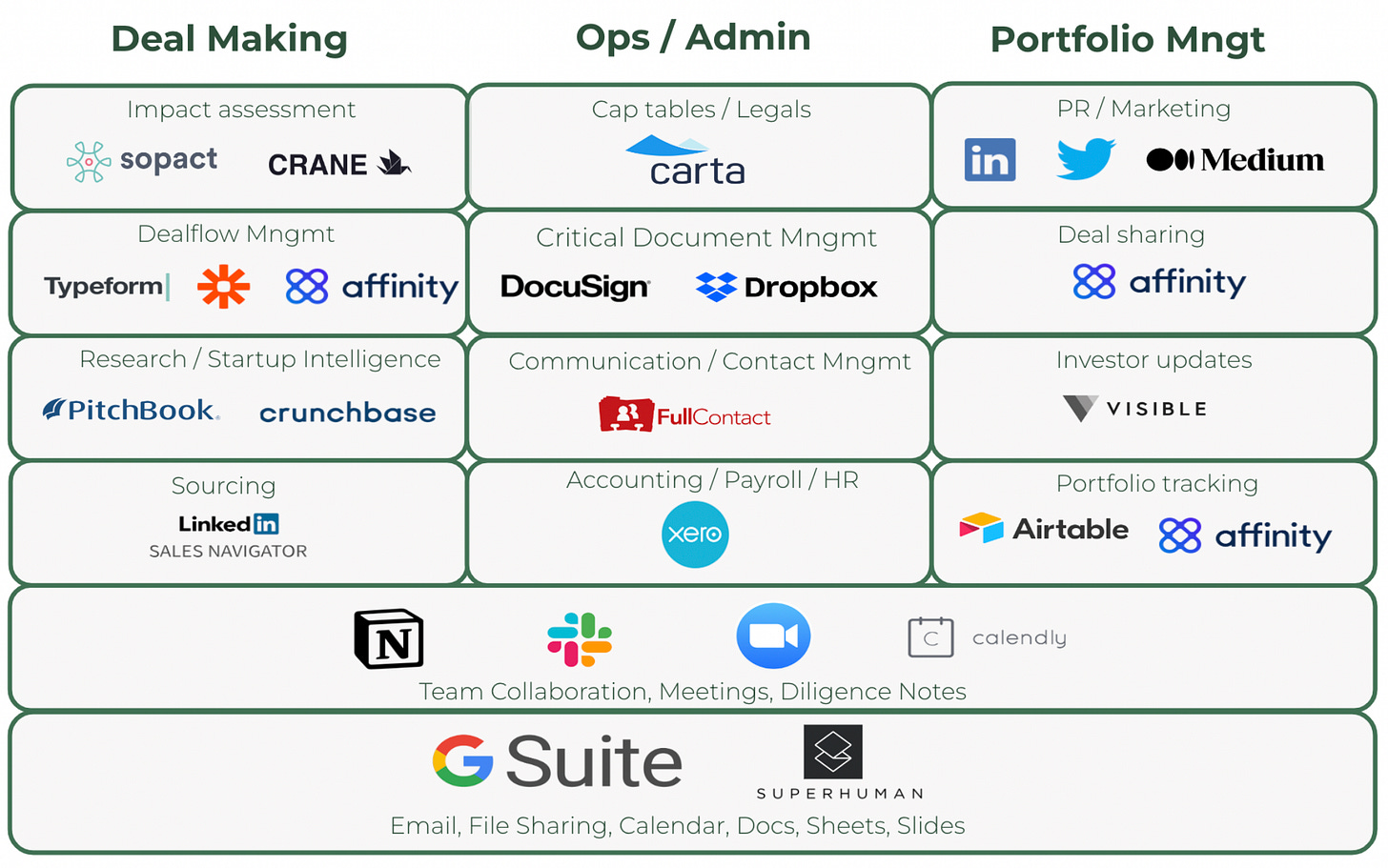

To help you stay ahead, I've curated the ideal tech stack. With the right tools, you can automate processes, optimize your time, and smoothly handle the numerous deals and portfolio interactions.

In a nutshell, this is what it looks like 💥

Let's break down the 5 major tools you need to use:

1. Deal Sourcing 🧲

Inbound top-of-the-funnel opportunities can come from various sources: LinkedIn, Email, Whatsapp Groups, Slack communities, etc. While you can automate around 70% of it, the remaining 30% requires manual entry, one by one 👉⌨️. That's why VCs often hire Analysts or interns.

I suggest using a combination of Typeform, Google Form, or Airtable Form to capture new entries and allow founders to apply and upload their pitch deck.

However, it's important to ensure that your form is not too long. Founders are tired of repeatedly inputting their data. If it takes more than 10min or if you're asking for complex, custom questions, they will bounce.

Now, let's talk about Outbound opportunities.

Pitchbook, Crunchbase (FREE version), or LinkedIn Sales Navigator are all great solutions that provide access to a wide range of deals listed on the internet.

Once an opportunity has entered your ecosystem, what's next?

2. Relationship Management: Affinity 💬

Save yourself months of experimentation. If you have a budget of $2-5k per year for tech tools, simply sign up for Affinity. It is specifically designed for VCs, and most funds have been using it for a decade.

Affinity allows you to manage all interactions with startups, stakeholders, and other VCs.

Why it's great: Affinity's AI analyzes your communication patterns to remind you of follow-ups, ensuring that no potential deal falls through the cracks.

Real-world example: Affinity sends a nudge to reconnect with a startup you met at a conference 2 months ago. You can see that your colleague has already exchanged emails and had an initial call. You can check the notes, status update, and know what to focus on during the next call.

3. Due Diligence 📝

You need a collaborative space to compile all your research on potential investments.

I personally have grown fond of Notion, but still use Google Drive to track all files, legals, and important docs.

Why is Notion great: its flexibility lets you create tailored templates for every deal, ensuring a systematic due diligence process.

Real-world example: Your team, spread across three countries, seamlessly pools together research on a potential investment's tech, market fit, and team credentials—all in one organized Notion space.

If you follow Steps 1, 2, and 3, this is how it flows from the top of the funnel all the way down to the Investment Committee:

4. Portfolio Tracking: Carta 📊

Once the deal is sealed and you need a comprehensive overview of your entire portfolio.

Why it's great: Carta offers real-time updates on your investments' cap tables, valuations, and more. It provides detailed information.

Real-world example: With just a quick look, you notice that three of your portfolio companies have achieved significant valuation milestones this quarter. It's time to include a note in your LP updates and plan your next steps!

5. ESG/Impact Reporting 🍃

This is probably the decision that will require a bit more experimentation as there’s no clear winner as of 2023.

A couple of options:

-For CO2 emission tracking: Crane (FREE)

-For general ESG and SFDR (European specific) reporting: Sustainalytics, Clarity.ai, Worldfavor, KeyESG

-For general impact tracking: Sopact

When to use: When measuring the ESG impacts of your investments and ensuring streamlined compliance with SFDR and CSDR regulations. Listen to our Impact Measuring Podcast episode 🎙 to get started, and read this high level step-by-step guide.

Conclusion

How much is all of this going to cost?

Here are the major cost drivers:

Affinity: $1,800 per year per user

Carta: $2,800 per year per organization

Pitchbook: $1,000-1,500 per year per user

LinkedIn Sales Navigator (Not a must): $150 per month per user

The remaining monthly licenses generally cost around $20 per user per month: Zoom, Calendly, DocuSign, Typeform.

What about a super low-cost stack?

To keep costs extremely low, you can create templates for each step and use: Notion + Airtable + Google Drive as a backbone.

Want some juicy discounts? There you go! 🤑 (6 months Notion Free, $750 FREE on Carta, 30% Off Slack,…)

I will keep updating this post as I discover amazing tools and discounts.

Would love to hear your tips and suggestions in the comments! 🙏

Whenever you're ready, there are 2 ways I can help you:

Invest In Climate Tech Like A VC 🎓: Join over 200 students in my cohort-based course to learn how to find unique Climate Tech startups that will change the world, and how to start investing in them regardless of your budget.

Join my Climate investor community 🚀 Unlock access to groundbreaking climate deals. Dive into transformative deals like our recent nuclear fusion venture and two pioneering moonshot projects.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏