Hey 👋 - Yoann here.

Each Saturday, I send out one insight to support the growth of your Climate Tech startup or fund.

It can be read in less than 4 min.

Enjoy!

Okay, that’s a fact.

The market sentiment has fully rotated toward a market downturn outlook.

Investors have fled from growth and speculative assets and many are calling it a recession…

The truth is, it's still uncertain how the markets will play out over the next 12-18 months.

As Climate fund managers and startup founders, we need to prepare for every eventuality.

Here are 4 implications we anticipate in Climate Tech this year:

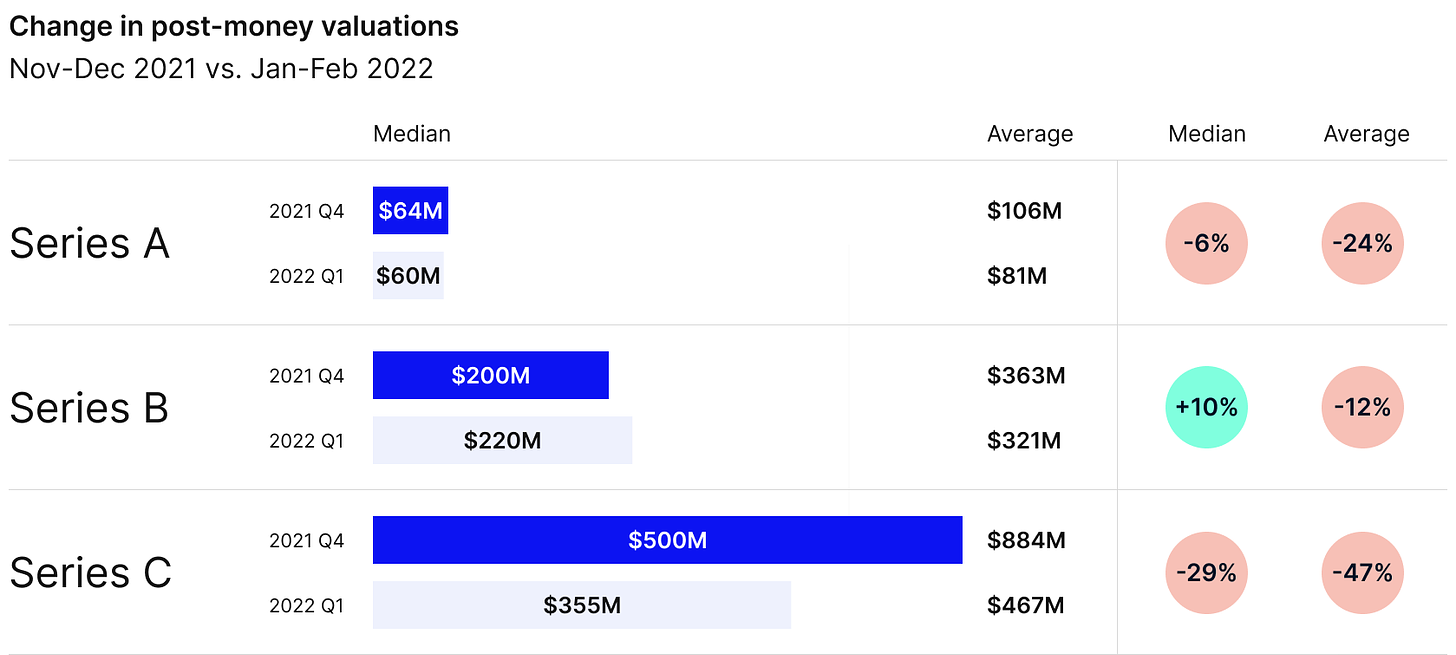

Valuations will take a hit. It’s especially true in the US but hasn’t fully materialized in Europe just yet. According to Carta data (chart below), deals in the growth stage across all sectors have seen the most significant dip in valuations as growth stage multiples most closely mirror the public equities market.

Deal pacing will slow. According to CB Insights, VC funding in Q1 dropped 20% quarter over quarter (see chart below).

Fundraising cycles will slow. The length of time for a successful fundraise may also lengthen for the majority of startups and fund managers.

Market uncertainties generally lead to the retreat of institutional capital which historically has had a significant effect on venture capital supply.

A reduction in VC supply typically results in a reduction in deployment pace and valuations.

Yet, Innovation will continue unabated. As with prior market downturns, we do not believe there is much correlation between economic cycles and the formation of category-defining companies. Companies such as Uber, Airbnb, Square, WhatsApp, MailChimp, and Adobe were all founded during recessionary periods.

Tomorrow’s category defining companies in Climate Tech will continue to launch and observe pent-up demand.

Innovation will not slow. Instead, layoffs often create a robust environment for new company formation and consolidation of top talent. Innovation tends to thrive in periods of disruption.

Conclusions:

We are optimistic that this current vintage will greatly benefit greatly from this reset. It might actually become one of the best.

There’s still a ton of dry powder in European VC from 2021 (€30B is yet undeployed across all sectors), so more fun(d) times ahead for euro startups!

Venture will continue to be a top performing asset class, so fasten your seat belt and prepare for the ride! 🎢

LATEST EPISODE OF THE PODCAST:

Alternative meat: is Europe late to the party? - with Planted’s co-founder Pascal Bieri

To continue improving the podcast, I’d SINCERELY appreciate your thoughts and feedback. Here’s a feedback form to quickly capture your impressions.

It only takes 3 min 🙏

That's all for this Saturday. Simple insights in less than 4 minutes.

If you're not getting value out of these tips, please consider unsubscribing.

I won't mind and there are no hard feelings.

Alternatively, if you are enjoying this newsletter, the best compliment you could pay me would be to recommend it to a friend or share it with others on LinkedIn or Twitter.

See you again next week.

Cheers,

Yoann

With Climate 💚