Hey 👋 - Yoann here.

After a break, we’re back with a new edition of The Saturday Climate Insider.

Each Saturday, I send out 1 actionable tip to support the growth of your Climate Tech startup, your fund, or your career.

It can be read in less than 4 min.

Enjoy!

🙏 Welcome to the 147 new subscribers since the last post!

In bearish economic environments, markets tend to abandon risks and swing to ‘safer’ strategies.

Everyone knows markets are cyclical, yet most investors tend to fly to safety and forget the fundamentals.

The truth is, the best returns are made in oversold assets, during bear markets.

It is particularly true in Venture Capital, where the best fund vintages tend to be built during economic slowdowns.

I want to take this opportunity to revisit the 3 core principles that drive VC returns and explain WHY continuing to take risks is the name of the game!

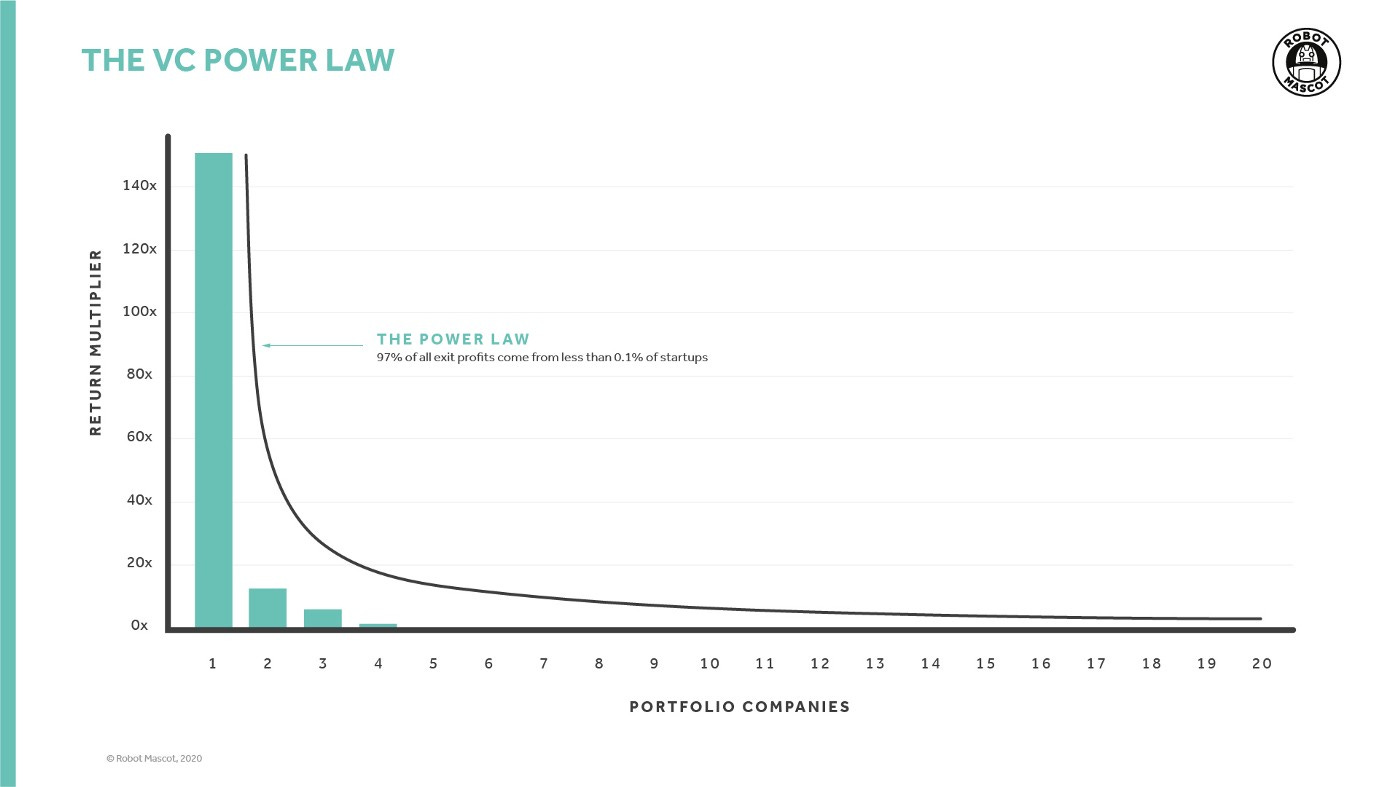

Principle 1: VC follows a Power Law distribution. Only home runs matter.

65% of venture deals return less than the capital invested in them.

For the best-performing funds, 90% of their returns come from less than 20% of their investments.

The best-performing funds actually have more loss-making deals than the average funds.

Conclusion #1 —> Venture Capital is a game of home runs, not averages. It rewards risk and failed investments don’t matter.

Lesson 2: All you have to do is to maximize the chances of hitting a Home-Run

More deals equal more chances to hit home runs

Data shows that less than 6% of investments return above 10x and only a tiny fraction are in the 50x+ category

The industry would be better served by doubling or tripling the average number of investments in a portfolio

To pick the winners effectively, follow those simple principles:

Team: Back the Jockey, not the horse. The vision and talent of the founders are the drives behind everything in the company.

Scalability: Invest in scalable startups designed with the intent from day one to become enormous companies.

Unfair Advantage: Invest unfair understanding of their space, unfair product, unfair access to customers or partners, or unfair access to capital

Timing: Invest at the critical inflection point when the enabling technologies are in place, there’s real economic momentum, and customer readiness is sufficient.

Conclusion #2 —> The number of deals matters. The rest is judgment and selection skills.

Lesson 3: The right follow-on strategy is critical. Double down on the winners

A mistake that many VC funds make is to quickly invest all of their capital and leave no dry powder for follow-on investments.

Data shows that 60% of the money in a VC fund should be reserved to follow on and double down on the portfolio winners to optimize returns.

Conclusion #3 —> Initial investments are the tip of the iceberg. Keeping sufficient capital to back the winners drive the true economics of a fund.

In bull AND bear markets, the performance of VC funds is analogous to the performance of individual deals: a few home runs and a lot of strikeouts.

Returns of public stocks follow a ‘normal’ distribution while venture capital returns, both at a deal level as well as at a fund level, follow a power law distribution.

All of this implies that investors looking to succeed in the venture capital space must internalize the concepts and implications of the power law: take more risk, spread across a wider portfolio, and double down on the winners.

HERE IS THE LATEST EPISODE OF THE PODCAST:

SOSV - Building the World's Most Active Climate Tech VC (feat. partner Benjamin Joffe)

To continue improving the podcast, I’d SINCERELY appreciate your thoughts and feedback. Here’s a feedback form to quickly capture your impressions.

It only takes 3 min 🙏

That's all for this Saturday. Simple insights in 4 minutes.

If you are enjoying this newsletter, the best compliment you could pay me would be to recommend it to a friend or share it with others on LinkedIn or Twitter.

See you again next week.

Cheers,

Yoann

With Climate 💚 from Climentum Capital