Read time: 3 min

I’ve seen thousands of pitch decks, and I can tell you: nearly everyone gets their ‘Ask Slide’ wrong.

The sad part? They’re all making the same mistake.

Let’s fix that.

What’s Wrong with Your Ask Slide?

Let’s start with the basics: the classic Ask Slide is almost always the last in the deck, and it looks something like this:

Sound familiar?

Here’s why it’s a disaster:

1. Bad Timing.

Dropping the Ask at the end is a terrible move. No investor is going to write a check on the spot.

2. Awkward Negotiations.

By suggesting equity percentages, you’re putting yourself at a disadvantage.

Investors are pros—they negotiate for a living.

You’re better off letting them go first.

3. Pointless Pie Charts.

Nobody cares about a pie chart showing 13% for CAPEX. It’s fluff.

All it does is open you up to questions you can’t answer.

Instead of helping, it makes it look like you haven’t asked yourself the right questions.

What’s Missing from your Ask Slide?

Your slide probably tells investors the amount you’re raising, but that’s about it.

Here’s what’s missing:

How much cash you need over the life of your startup.

When you plan to raise your next round.

When you expect to hit cash flow break even.

Your projected revenue at cash flow break even.

These metrics don’t have to be perfect; no one expects you to nail every estimate.

But they help investors see how you think about your business.

It shows you’re serious, realistic, and have a grasp of your financial roadmap.

What Your Ask Slide SHOULD Look Like

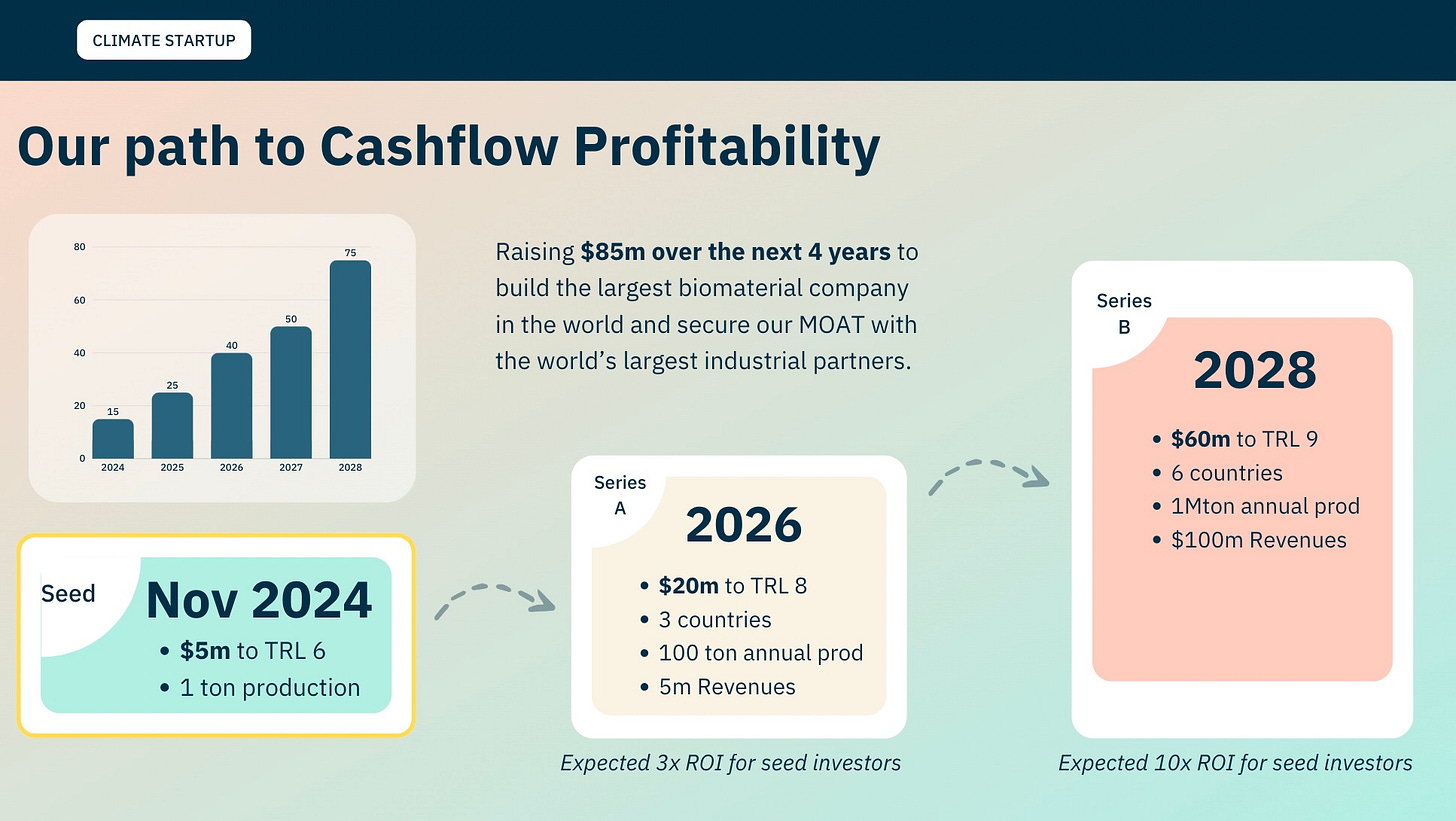

Here’s the secret: your Ask Slide should look more like a well-crafted financial journey slide.

Think of it as painting a complete financial picture of your company’s future.

Here’s what to include:

How much you’re raising now.

When you’ll need to raise again.

Total equity funding needed until breakout milestones.

Projected timeline to cash flow break even.

Expected revenue after this breakout.

Want to reuse my template slide? Use this link 🪄

Make It Easy for Investors

Remember, raising money is a high-stakes sale.

Your job is to reduce investor risk, not increase it.

The traditional Ask Slide doesn’t help investors understand your business, it raises more questions than it answers.

Investors want to see how you envision your company’s future. Show them the path, not just the immediate ask.

Remove the guesswork.

Reduce the risk.

And you’ll have a far better shot at closing that funding round.

👉 Want to invest in a green mining startup backed by Lowercarbon & Unruly? 👩🏻🔬 Climate Insiders is closing its latest investment. We’re organizing a Q&A with the founder on Monday 6pm CET.

Want to join? Just reply to this message and I’ll share more details.

Many Thanks for your Input