The VC Fund Manager’s Bible

Everything You Need to Build, Raise, and Scale a Game-Changing Fund

“Don’t start your fund before knowing what you’re getting yourself into.”

Fund Manager:

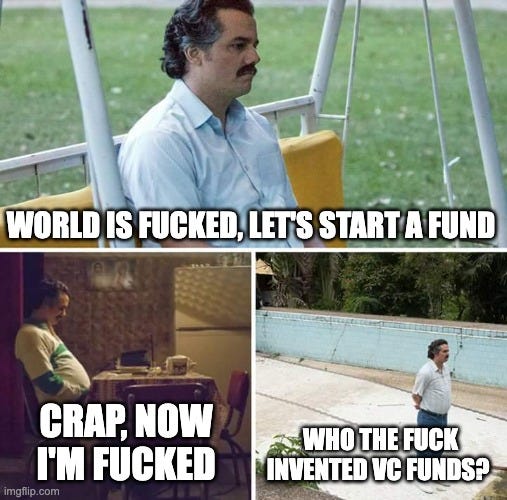

Running your own venture capital fund isn’t just a career move. It pretty much feels like this:

But let’s be honest: getting there feels like climbing Everest.

How do you raise capital when LPs are flooded with options?

How do you compete with the Sequoias and a16zs of the world?

And how do you balance risk while aiming for top-quartile returns?

This guide is your playbook to success. Packed with the best frameworks, resources, and mental models from top VCs, it’s everything you need to hit the ground running.

💡 Want to skip the guesswork?

👉 Subscribe to the premium newsletter to unlock the full article, including fund deck examples, LP strategies, and actionable Climate Tech resources.

📂 What’s Inside?

Mental Models of Top VCs

Insights from the likes of Naval Ravikant and Marc Andreessen.

Fundraising Masterclass

Proven strategies for attracting Limited Partners (LPs).

Fund Deck Examples

Real-world examples from successful generalist and Climate Tech funds.

Deal Flow Mastery

Build pipelines that give you an edge over the competition.

Portfolio Construction Frameworks

Balance risk, maximize returns, and embrace the power law.

LP Management & Reporting Tools

How to build trust and keep your LPs coming back for future funds.

Special Section: Climate Tech Opportunities

How to ride the wave of the fastest-growing VC sector.

🌟 Why This Toolkit Matters

90% of VC funds fail to outperform the market consistently.

And it’s not just because of bad investments. Many fail to:

Raise from the right LPs who share their vision.

Build strong deal flow pipelines early.

Construct portfolios that account for the power law (where 1-2 companies drive 80% of returns).

The top funds—like Sequoia, a16z, and Lowercarbon Capital—have cracked the code. This guide distills their playbooks, tools, and systems into actionable steps for you.