Read time: 3 min

Well, here we are.

Trump’s return might just be the worst climate news of 2024.

There was competition for the title, but this… is bad.

For anyone hoping to slow climate change, regardless of political views.

But is it game over?

1. It’s Gonna Get Messy

If Trump follows through on his promises, it’ll mean massive setbacks:

Goodbye Environmental Protection Agency.

Goodbye NOAA (National Oceanic and Atmospheric Administration).

Goodbye Paris Agreement—and our last shot at +1.5°C (already a long shot).

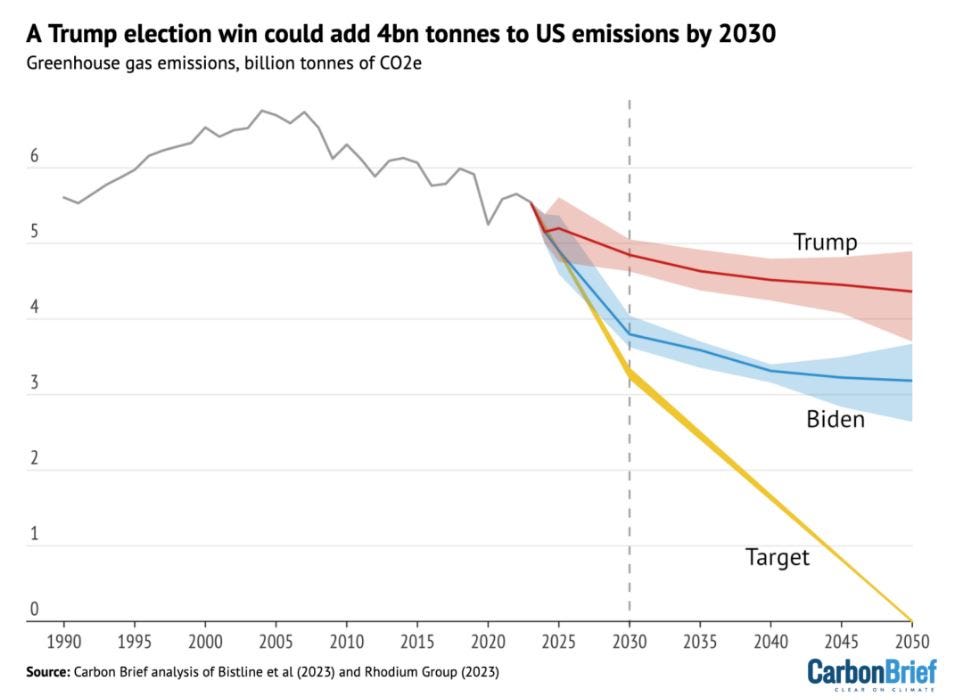

Back in March, Carbon Brief estimated Trump’s election could add 4 billion tons of emissions to the U.S. by 2050.

For context? That’s enough to blow past U.S. climate targets, locking us into a dangerous path toward 3.1°C warming.

2. The IRA Stands—For Now

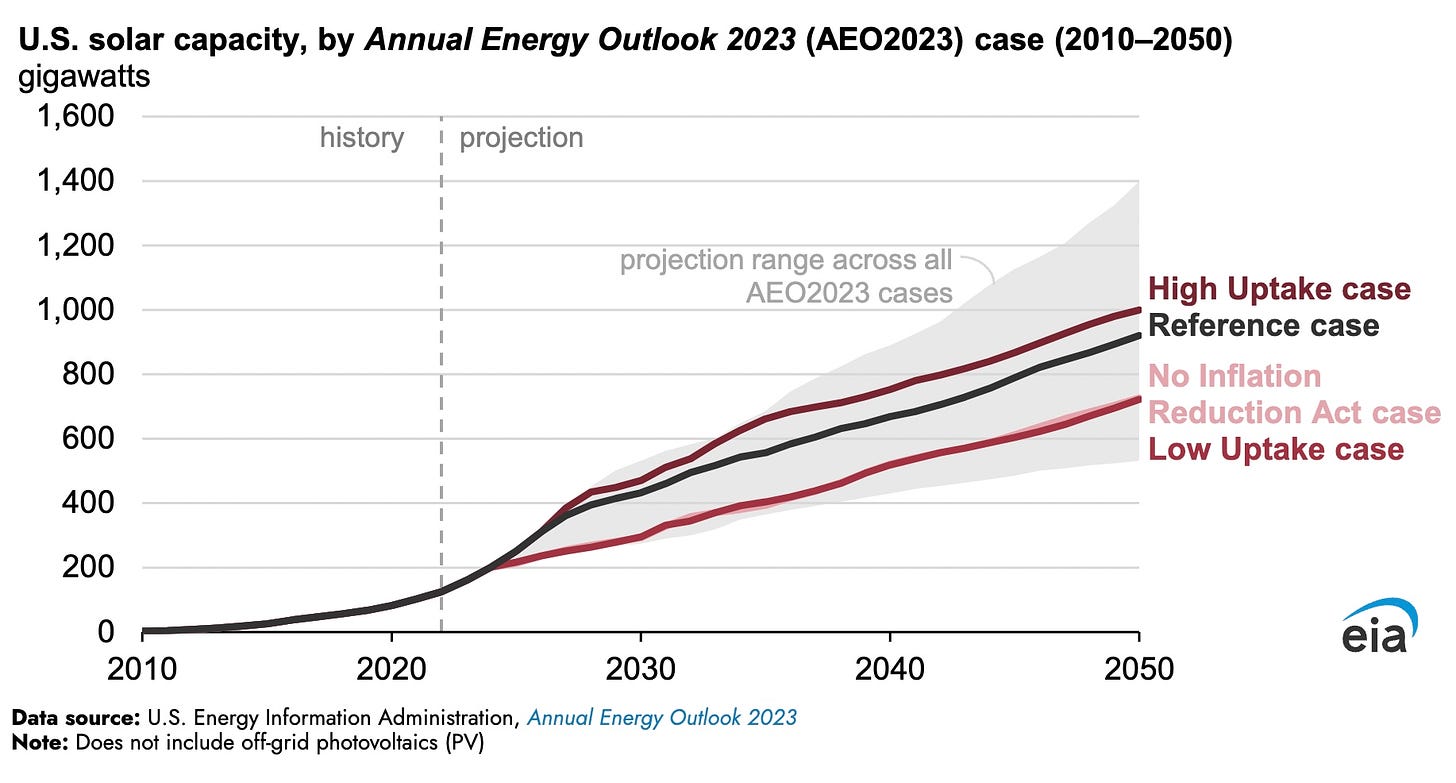

The Inflation Reduction Act (IRA) is still the U.S.’s biggest climate investment.

A $369 billion push for clean energy and emissions cuts.

And it’s here to stay...for now.

Repealing the IRA would gut renewables, with BloombergNEF predicting a 17% drop in new capacity by 2035. Offshore wind alone could plummet 45%.

Yet, the IRA’s reach goes deep—even in Trump territory.

Nearly 75% of new clean energy projects have landed in Republican districts.

In fact, 18 House Republicans just signed a letter urging Congress not to repeal the act’s energy tax credits.

In 2023 alone, the U.S. added 13% more renewable capacity—now totaling 300 GW.

The IRA is making waves, and dismantling it won’t be easy.

3. Europe: The Safe Harbor

Europe is calling.

With the European Green Deal, Europe has pledged €1 trillion for climate and energy goals through 2030.

It still is a stable environment for growth, free from the political whiplash in the U.S.

For climate tech companies, it’s a safe harbor where projects can scale without fear of sudden policy rollbacks.

And Horizon Europe’s €95 billion fund remains a critical partner for U.S. startups seeking stability.

4. The Unexpected Upside: M&A is About to Explode

Trump’s win has Wall Street pumped.

The anticipation?

Stocks and cryptos going to the moon 🚀

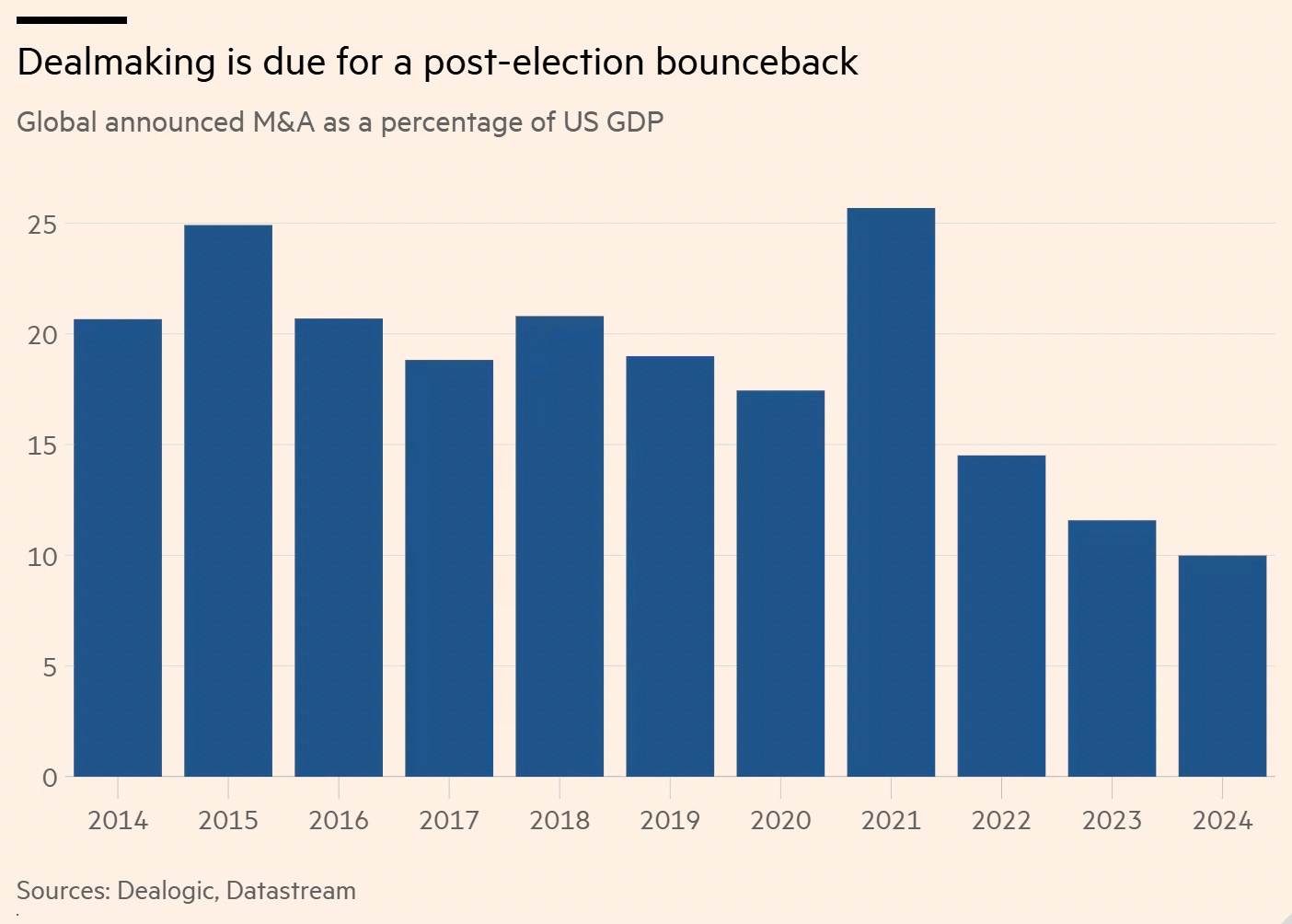

And a major spike in mergers and acquisitions (M&A) across industries.

Companies like Qualcomm, Intel, U.S. Steel, and Nippon Steel are expected to announce huge deals.

His plan to cut regulations, slash taxes, and ramp up fossil fuel production has triggered optimism.

The Financial Times reports that “transformational deals” and a huge trend reversal are underway.

What does this mean for Climate?

This wave of M&A is likely to spread.

It could offer liquidity and new exit pathways for climate tech.

And a path to liquidity is exactly what climate needs right now to rebuild momentum.

Institutional investors need credible paths to liquidity.

Parting thoughts

Americans voted and Donald Trump won the election democratically and without stealing it.

The path forward, though, is still ours to shape.

The plan is clear: harness what’s left of the IRA, tap into Europe’s stability, and ride the spreading M&A wave to rebuild momentum.

The climate fight isn’t over.

Not even close.

Ready to join the fight?

I think “game over” is the correct verbiage…. That was the case in 16. I don’t think you can reset this clock