Read time: 4min

Look.

I’m a feminist.

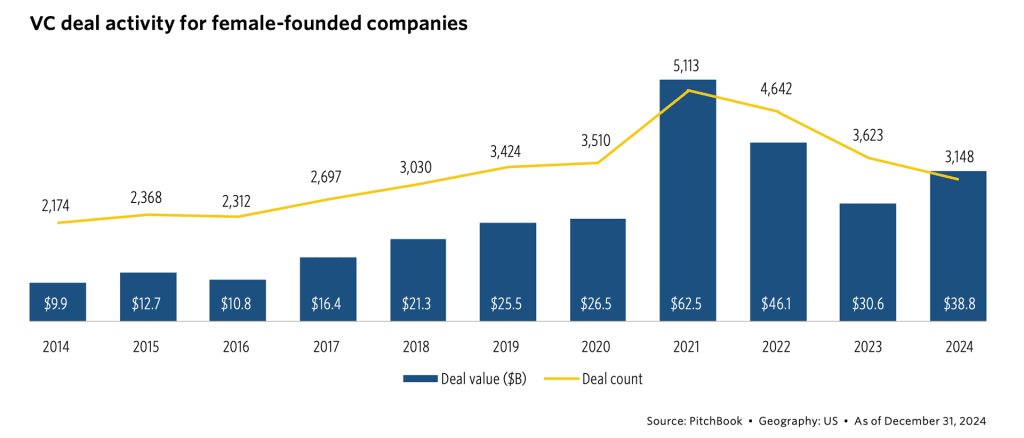

And I think it’s fucked up that less than 3% of venture funding goes to female founders.

Source

Another source.

And it’s getting worse.

2024 saw the lowest funding for women-led startups in recent history.

$1 for women for every $33 men get.

That’s not a gap.

It’s a canyon.

What’s wild?

Women-run startups statistically deliver higher returns.

Companies with a female founder performed 63% better than male founding team.

Study here.

They also make better VCs, according to Forbes.

Sharper questions.

Less ego.

More long-term thinking.

So yeah, we’ve got a problem.

But we’ve also got badass women cracking the system.

Founders who are gaming the venture playbook and winning.

Not because they were chosen.

But because they built something that couldn’t be ignored.

What I want to do here is shine a light.

On the female CEOs who raised millions.

By telling a better story.

Through one powerful thing:

A killer pitch deck.

Not just pretty slides.

A story that converts.

So I went hunting.

And found 15 pitch decks from brilliant women across Pre-Seed to Series C.

Different industries. Different paths. Same outcome:

They closed.

Use these to learn.

Steal.

Adapt.

And fund the hell out of your idea.

👇 Full list + breakdown below.

The Full List: 15 Female-Founded Decks

1. Stytch

Stage: Series B

Amount: $90M

Investors: Index Ventures, Benchmark, Coatue

Year: 2021

Authentication platform for developers.

Clear market, simple product, obvious growth story.

Slides: Link

2. Nylas

Stage: Series C

Amount: $120M

Investors: Bossanova, Tiger Global, 8VC

Year: 2021

Built the engine behind email, scheduling, and workflow automation.

Slides: Link

3. Front

Stage: Series C

Amount: $59M

Investors: Eric Yuan (Zoom), Frederic Kerrest (Okta), Jared Smith

Year: 2020

The modern customer communication platform. Massive logos. Real traction.

Slides: Link

4. Softr

Stage: Series A

Amount: $13.5M

Investors: FirstMark, Atlantic Labs, Scott Belsky

Year: 2022

No-code builder for apps, marketplaces, and communities.

Slides: Link

5. Catch

Stage: Series A

Amount: $12M

Investors: Khosla Ventures, Crosslink Capital, Nyca

Year: 2021

Payroll + benefits for freelancers. Big underserved market.

Slides: Link

6. Ledgy

Stage: Series A

Amount: $10M

Investors: Sequoia, btov Partners, Creathor

Year: 2021

Equity management for international teams. Tight execution.

Slides: Link

7. Morty

Stage: Series B

Amount: $25M

Investors: March Capital, FJ Labs

Year: 2021

Fixing the mortgage market with a clean digital platform.

Slides: Link

8. Beelinguapp

Year: 2020

Stage: Pre-Seed

Raised: $1.1M

Investors: Joyance Partners, EquityPitcher Ventures

Beelinguapp helps people learn new languages naturally through audiobooks, news, and songs, with side-by-side translations that tap into how the brain learns best.

Slides: Link

9. Remi

Year: 2021

Stage: Pre-Seed

Raised: €1.2M

Investors: btov Partners, Rolf Schromgens, Tim Schuhmacher, and more

A platform to help distributed teams build culture—async rituals that create trust and connection like reps in the gym.

Slides: Link

10. Lago

Year: 2021

Stage: Pre-Seed

Raised: $125K

Investors: Y Combinator, Julien Codorniou

Open-source billing platform for product-led startups. Usage-based pricing, subscriptions, hybrid models, you name it.

Slides: Link

11. The Plate

Year: 2021

Stage: Pre-Seed

Raised: $1.3M

Investors: Village Global, GE Ventures, FoodLab

A livestream platform for culinary creators. Chefs share their skills, build communities, and monetize through subscriptions.

Slides: Link

12. Passionfroot

Year: 2021

Stage: Pre-Seed

Raised: €3M

Investors: Creandum, Chris Murphy, Johannes Reck, and more

No-code storefronts for creators to sell services, automate ops, and look pro doing it.

Slides: Link

13. clare&me

Year: 2022

Stage: Pre-Seed

Raised: €1M

Investors: Antler, YZR Venture Capital, Hans Raffauf, and more

An AI-powered mental health coach. Clare supports users via voice and text—like therapy, but always on call.

Slides: Link

14. Exakt Health

Year: 2021

Stage: Pre-Seed

Raised: $500K

Investors: BackBone Ventures, Possible Ventures, Maximilian Tayenthal, and more

Digital physiotherapy for athletes—get expert guidance to treat sports injuries from your phone.

Slides: Link

15. Perfeggt

Year: 2022

Stage: Pre-Seed

Raised: €1.1M

Investors: Eric Quidenus-Wahlforss, Verena Pausder, Deepali Nangia, and more

Plant-based eggs, made in Berlin. Building a food system that’s ambitious, kind, and protein-packed.

Slides: Link

🔓 Want More Like This?

Premium subscribers get all the tools, decks, and templates I’d kill to have when I was raising.

Here’s what’s inside:

🦄 40 pitch decks that built Unicorns (how Airbnb, Coinbase, Canva got funded)

💰 The Ultimate Investors List of Lists (12k+ VCs, angels, family offices)

📊 The Only Finance Tracker Your Startup Needs

⚡️ The Ultimate Notion Data Room (all key docs you’ll EVER need)

🥇 The Most Successful Investor Update Template

⚖️ SAFE Note Dilution Calculator & Cap Table Builder

👯 Co-Founder Agreement Templates + Legal Clauses You Can't Forget

All in one spot. Yours forever.

👉 Subscribe now to get everything at 25% OFF forever

—Yoann

P.S. If you’re a female founder building in climate deeptech, hit reply. Would love to learn about your project.

Hey Yoann, This is so kind of you to put together and share. On behalf of all female founders attempting to raise millions, we appreciate your generous soul immensely 🙏💚💚💚💚🌎🌍🌏🍀

Hello Yoann,

I hope this communique finds you in a moment of stillness.

Have huge respect for your work and reflective pieces.

We’ve just opened the first door of something we’ve been quietly handcrafting for years—

A work not meant for everyone or mass-markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where conciousness and judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, vision, patience, resilience and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral.

But it’s a multi-sensory experience and built to last.

And, if it speaks to something you’ve always known but rarely seen heartily expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to experience it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.