5 Contrarian Views in Climate Investing That Will Shape Our Future 💥

🔥🤯 You are now 1,000 followers, with 200 in the last month alone! I'll do my best to continue delivering unique and insightful content. Please continue spreading the word. Together, we are the ultimate force multiplier to drive true climate action.

Navigating the world of climate tech investing in Europe, I've felt the weight of traditional thought bearing down on me. As an investor consistently pushing the boundaries of conventional wisdom, I’ve often been met with resistance.

Europe, with its rich history, sometimes clings to conformist and conservative perspectives. Yet, if we are to create significant change within a decade, we need audacious thinking.

Here are five contrarian views I passionately believe should become the norm:

Women: The Unsung Investment Maestros

It's time we challenge the patriarchal view in finance. Women, with their holistic, risk-averse, and long-term approaches, have shown prowess in investment decisions. Forbes wrote Why Women are better investors than men. A more recent Fidelity study shows women outperforming men by less—40 basis points or 0.4%.

For example, someone who invested a million bucks for 25 years at 7.4% would earn $530,657 more than an investor who netted returns of only 7%.

Scaling this up to a global climate level could potentially lead to transformative change!Venture Capital is ALL ABOUT RISK

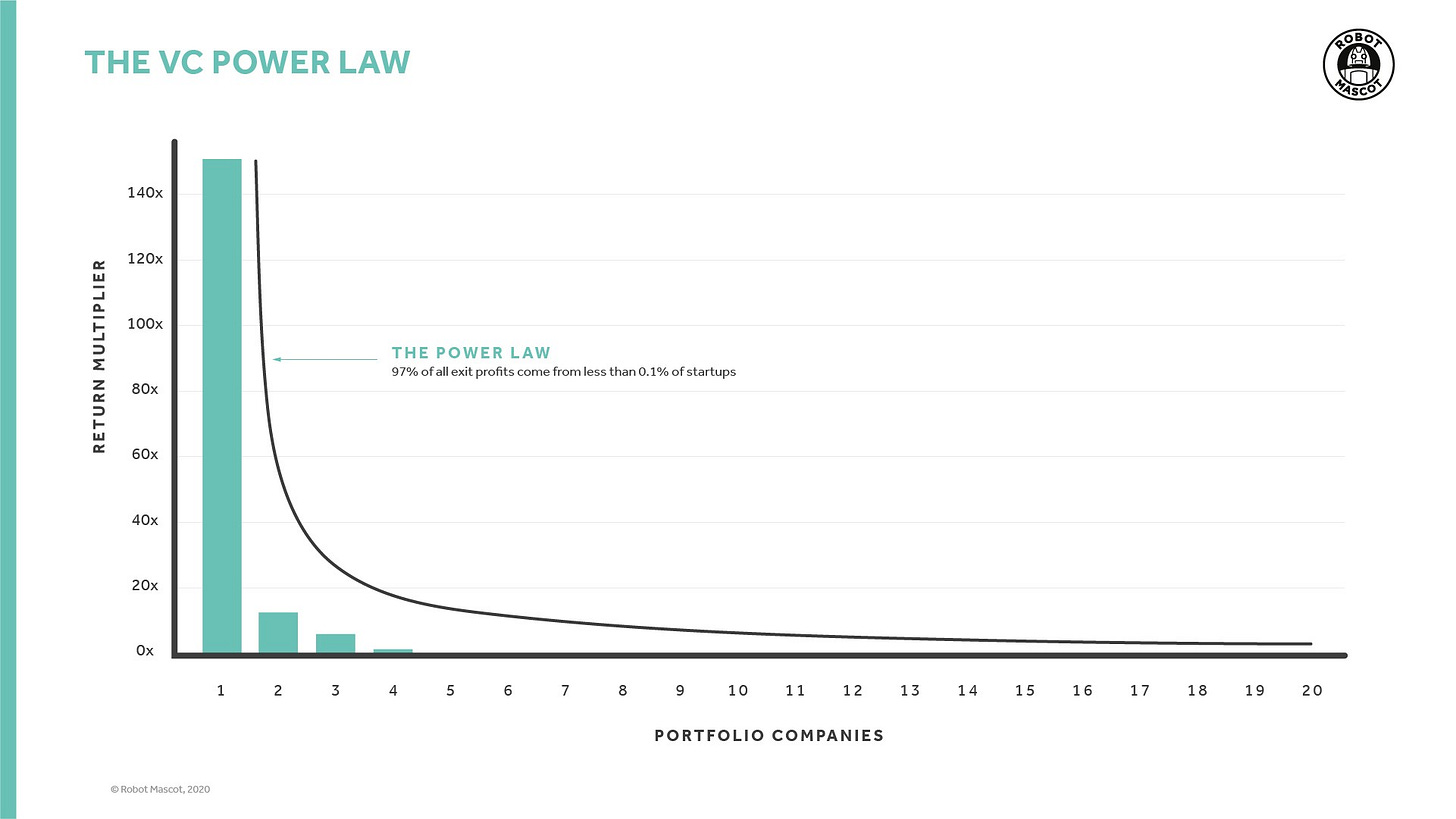

Venture Capital isn’t about de-risking investments. It's about seeing the future before anyone else does, taking the leap, and hoping your parachute deploys. Real venture capital is about maximizing risk, understanding the dramatic consequences of the Power Law, and coming up with pearls of innovation that the rest hadn't even noticed.

Vision Over Path

If history has taught us anything, it’s that visionaries carve their paths. An obvious route to market isn't always necessary for success. Think about game-changers like SpaceX or OpenAI. Their ultimate vision and potential societal transformation are so profound that they redefine markets. These startups don’t wait for society to set a valuation; they make society realize their worth.

Impact Measurement Timing

ESG and Life Cycle Assessment (LCA) are crucial, but when should they be implemented? Arguably, not at the early stages. Startups are fluid entities, continually evolving, with many shifting priorities. Initial stages should focus on product viability and market fit. Once they transition to growth stages, with more consistent operations, that’s the time for impact metrics.

The Corporate Expert Paradox

Involving corporate veterans in due diligence seems logical, right? They have experience and insights. However, they also carry the baggage of industry bias. Their understanding is framed by years within a structured environment, often blind to the next revolutionary idea. They can inadvertently stifle the very disruption we seek. That’s called the Innovators Dilemna.

Game-changing opportunities often lie beyond the reach and assessment capabilities of existing businesses. Take risks and bet on visionary entrepreneurs.

Conclusion

The past few years of my investing journey have been filled with lessons, pushbacks, and moments of profound clarity.

Europe, with its age-old traditions, might resist change, but I firmly believe that we're on the cusp of an investing revolution. The world's climate crisis demands that we think differently, invest boldly, and champion those audacious enough to envision a brighter, sustainable future.

Together, with the power of contrarian thinking, we can and will move mountains in the coming decade.

Whenever you're ready, there are 2 ways I can help you:

Invest In Climate Tech Like A VC 🎓: Join over 200 students in my cohort-based course to learn how to find unique Climate Tech startups that will change the world, and how to start investing in them regardless of your budget.

Join my Climate investor community 🚀 Unlock access to groundbreaking climate deals. Dive into transformative deals like our recent nuclear fusion venture and two pioneering moonshot projects.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏