Water tech: the most undervalued climate bet right now

It should be printing money. Here’s why it’s not (yet).

Read time: 4 min

Have you watched David Attenborough’s Ocean yet?

Seriously.

Go watch it.

In theaters now. Streaming June 7th on National Geographic, Disney+ and Hulu.

Water tech should be booming.

It sits dead center of climate adaptation, food security, national resilience, and let’s not forget, basic survival.

But despite all that?

The money’s been... slow.

And not because there aren’t great startups out there.

I know a ton of you building in this space:

Ocean farming.

Desalination.

Filtration.

Circular reuse.

Digital monitoring.

AI for water optimization.

So why isn’t capital flooding in?

1. It’s a costly, brutal bet

Water isn’t “move fast, break things.”

It’s:

Heavy capex

FOAK risk (first-of-a-kind deployment)

Long build cycles

Regulatory nightmares (especially in Europe — shocker)

As Charlie McGarraugh (OceanWell) says:

“This isn’t launching a better dating app. This is building physical infrastructure that keeps people, and species, alive.”

OceanWell is building deep-sea water farms.

Big vision. Big risk. Big dollars.

2. We still don’t know what water’s worth

This is where the whole financial system shorts out.

We’ve priced carbon.

We haven’t priced water.

And if investors can’t model price → risk → return?

They freeze.

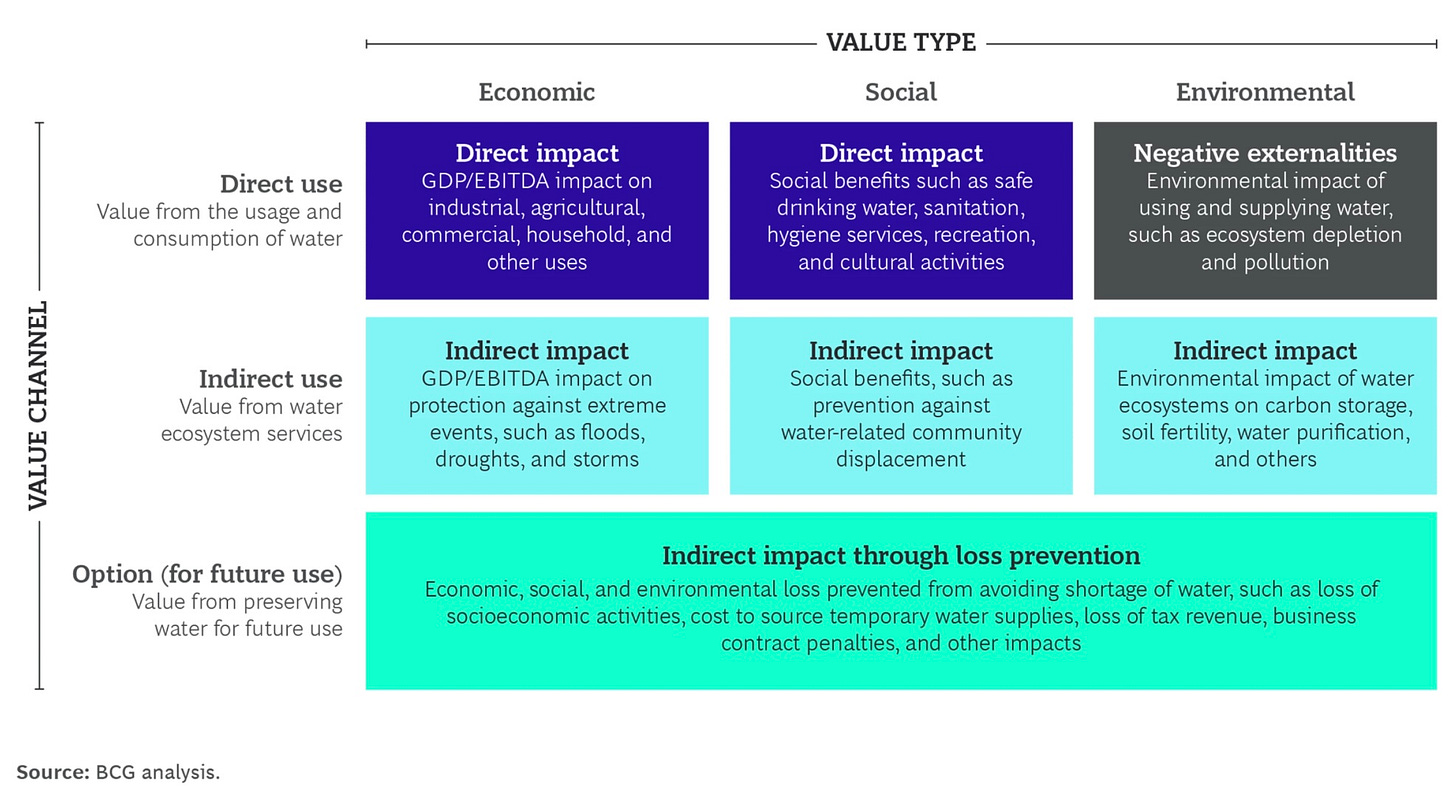

BCG’s Water Value Framework tries to change that:

Economic value.

Social value.

Environmental value.

And, most importantly, optionality value.

Until frameworks like this fully land?

Water stays a "philosophical asset" instead of a financial one.

3. The public-private gap is massive

Private capital isn’t enough.

You need governments to:

Validate the tech

De-risk deployments

Create real markets through procurement

Guarantee FOAK projects

Once that’s done?

Private capital floods in.

Until then? The flywheel spins slowly.

4. But the tides are turning

This isn’t a niche topic anymore.

Climate adaptation is now fully mainstream.

Middle East sovereign funds are piling into food & water security.

AI, crypto, quantum, robotics — all driving insane new demand for water.

And every major industrial sector is under pressure to cut water intensity — fast.

AI alone is a water monster:

Data centers? Massive cooling loads.

Nuclear SMRs to power AI? Yep, more water.

Quantum computing? Even thirstier.

Vertical farming? 100% water optimization.

Biotech / pharma / longevity? Insanely water dependent.

Even your damn jeans eat thousands of liters 👖 thanks Levi’s…

Water is the choke point.

Scarcity = value.

And the startups that shrink water use, recycle flows, or optimize systems?

They’ll capture that premium.

VCs are waking up.

Late. But they’re waking up.

🎯 Founder? Investor? Here's where you start:

I’ve been quietly baking the Water Tech Startups & Investors Lists.

✅ See who’s building:

Full list of water tech companies

Top trending ocean startups

✅ See who’s backing:

Fully curated. Immediately actionable.

The people actually writing checks.

🚨 Dropping Tuesday (paid plan only).

Because curating this takes weeks. But saves you months of fundraising.

PS: One quick thing before we close.

As capital starts finally moving into water, how you present yourself matters. A lot.

Especially when you’re pitching governments, sovereign wealth funds, or institutional LPs.

This is where Overstory comes in.

They don’t do trendy designs or AI-generated logos.

They build timeless brands for climate founders playing the long game.

Visual identities that survive funding rounds.

Decks that scream trust when it matters most.

A brand that makes serious investors take you seriously.

If you’re raising in water, energy, or climate?

Talk to Fabian at Overstory. Even if you’re not ready to hire.

Even if you just want a gut check.

👉 Book your free 15-min consult here.

You’ll walk away clearer on your next design move. Zero pressure.

And get the paid plan to put your startup on steroids:

📌 The Ultimate Investors List of Lists (12,000 VCs, FOs, Angels)

💰The Investor List No One Talks About: 140 Family Offices

🦄 40 pitch decks that built Unicorns (how Airbnb, Coinbase, Canva got funded)

⚡️ The Ultimate Notion Data Room (all key docs you’ll EVER need)

🥇 The Most Successful Investor Update Template

📊 The Only Finance Tracker Your Startup Needs

⚖️ SAFE Note Dilution Calculator & Cap Table Builder

👯 Co-Founder Agreement Templates + Legal Clauses You Can't Forget

👇 Get the list. Go raise.

Good post. Water is this unfathomably huge blind spot in pretty much every discussion of climate change, natural resources, adaptation, etc. Has anything been so taken for granted in the history of mankind? And yet we so woefully mismanage our water resources that places like Arizona are literally looking at contracting with the Mexican government to pipe desalinated water from the Gulf of California. This is Mad Max-level stuff…we need to do better as a society.

Also, you say “we’ve priced carbon” but that’s really only half true. Carbon pricing is a highly fragmented market at best and no one really prices it at a level that will meaningfully reduce emissions. Instead, we’ve padded Tesla’s otherwise meager profits from all the credits they sell. Capitalism! 😍😍😍

Excellent story, thanks. You're right about the dynamics and friction that makes startups hard. Pricing is highly political and low prices reduce need for efficiency. Industries will be squeezed and will be main buyers of water tech. Startups able to serve them will scale a d raise capital. But yes, slow growth story.

Gradient is a good example of a breakout. Unicorn (or thereabouts) in only 10 years.