Read time: 3 min

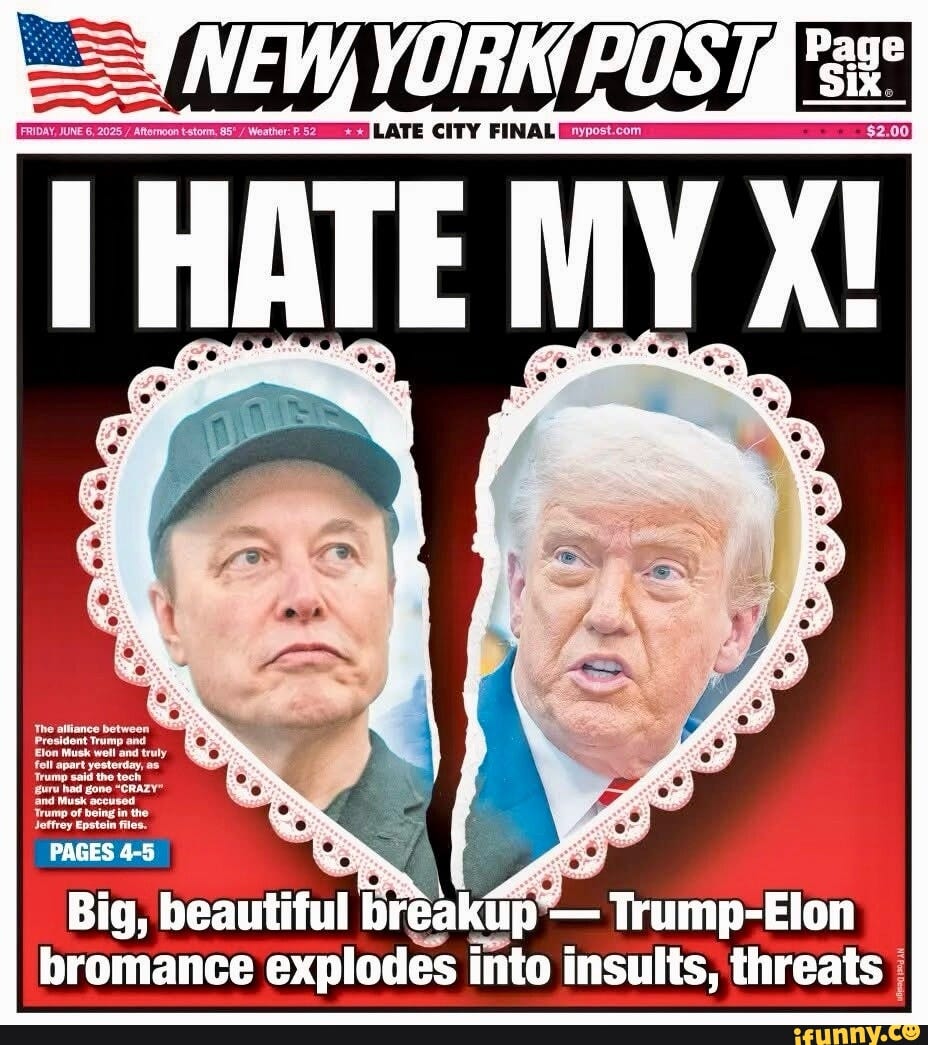

AI feels like the Trump-Elon bromance right now.

A perfect boom and bust setup. With a graveyard full of founders who moved too fast.

Everyone's looking at AI right now.

The energy. The capital. The talent.

It’s a feeding frenzy.

And don’t get me wrong, it’s not that AI isn’t exciting.

It is.

But the more I talk to founders, investors, and operators, the more one thing is clear:

Climate may be the stronger bet.

The AI trap

The problem with AI isn’t the tech.

It’s the market dynamics.

This game moves at brutal speed.

You build something.

You launch.

3 weeks later? 5 clones.

One’s cheaper. One’s open source. One’s VC-backed. Another one is running ads already.

The MOAT problem:

Most GenAI startups are thin wrappers on public APIs.

“Infrastructure plays” are often prompt templates with a fancy UI.

Pricing races to zero without real defensibility.

Frontier labs (OpenAI, Anthropic, Mistral) keep creeping into your layer.

And every time OpenAI drops a new model?

The entire early-stage stack reshuffles.

Founders are feeling it.

I’m hearing this on repeat:

Easy to land pilots. Impossible to close renewals.

Enterprise buyers kick tires, but procurement cycles kill deals.

Security concerns mean that not everyone can self-host, a model that requires more technical expertise.

Many confuse interest with product-market fit.

Teams burn cash trying to outrun the treadmill.

Even repeat founders (smart, battle-tested operators) are spooked by how fast and unstable this feels.

You need market stability to build a multi-year solid MOAT.

Climate moves differently.

Here’s why I’m doubling down on Climate:

1. Compounding, not sprinting.

Climate problems aren’t solved in 90 days.

But once you lock in partnerships, tech validation, offtakes, regulatory wins, it compounds.

You build wedges into trillion-dollar markets where speed alone isn’t the game.

2. Real-world moats.

Permits. IP. Deeptech. Supply chains. Policy alignment.

Moats that take work, but hold.

3. Once-in-a-generation tailwinds.

Policy (IRA, Green Deal, national security)

Capital (sovereign funds, family offices, infra investors)

Demand (food security, water security, energy resilience)

These aren't fads. These are structural shifts.

4. Real value, real buyers.

You’re solving problems that literally power civilization:

Water

Energy

Food

Industry

Materials

If you reduce capex, opex, or risk, you have real, enterprise-grade buyers.

Climate is messy. And that’s the point.

Yes, hardware is hard.

Yes, policy can be a maze.

Yes, FOAK projects take time.

But that’s where the durable companies are built.

You're not racing against a 12-year-old with ChatGPT in their bedroom.

You’re racing against the laws of physics, engineering, and capital formation.

I’ll take that race. It’s the ultimate MOAT.

If you’re building or investing, zoom out.

AI may move fast.

But Climate moves deep.

And that’s where the real generational wealth, impact, and defensibility are hiding.

Ready to build?

📌 The Ultimate Investors List of Lists (12,000 VCs, FOs, Angels)

💰The Investor List No One Talks About: 140 Family Offices

🦄 40 pitch decks that built Unicorns (how Airbnb, Coinbase, Canva got funded)

⚡️ The Ultimate Notion Data Room (all key docs you’ll EVER need)

🥇 The Most Successful Investor Update Template

📊 The Only Finance Tracker Your Startup Needs

⚖️ SAFE Note Dilution Calculator & Cap Table Builder

👯 Co-Founder Agreement Templates + Legal Clauses You Can't Forget

👇 Get all of this with one plan and build the utlimate MOAT

Very insightful. This was a great piece.

Thanks Yoann.

What do you think about using AI to find solutions to those environmental challenges that we are facing ?

Great to hear such views from VC investor! Not all are lost to AI craze))) Keep calm and keep building real stuff!