What Venture Capitalists Look for in Startups

From pitch to partnership, how to align with what really moves the needle.

Read time: 5 min

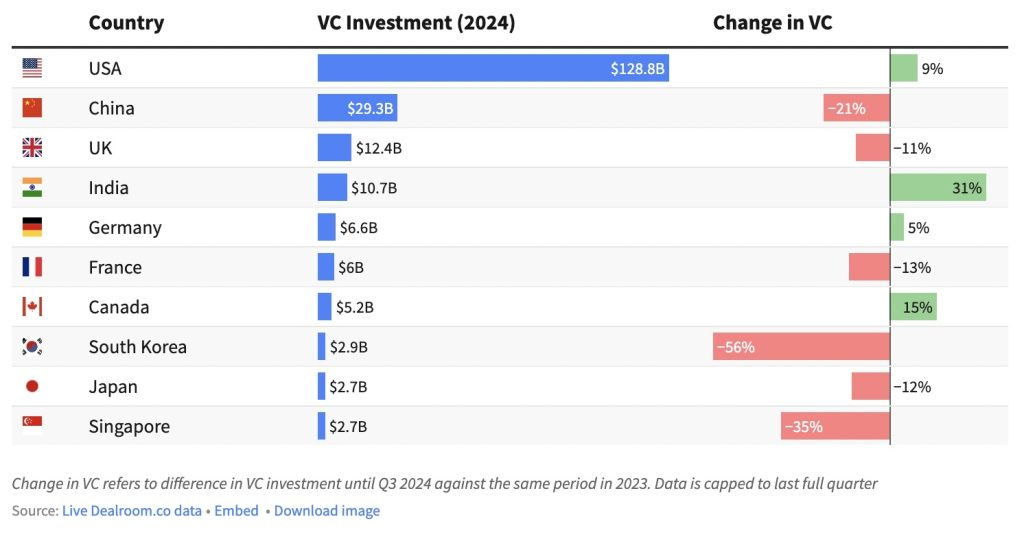

The global VC scene is shifting. Fast.

No one knows exactly what 2025 will bring.

But all signs point to more of what we saw in 2024:

Fewer checks. Slower timelines. Higher bars.

Translation?

It’s getting harder to fundraise.

Not impossible.

Just harder.

But here’s the truth most founders miss:

VCs don’t fund ideas.

They fund outcomes. Returns.

More so now than ever.

So even if your startup is important, even world-changing.

If you’re not speaking their language? You’re out.

The good news?

There’s a checklist.

An unspoken one.

That top founders instinctively hit, and most miss entirely.

I pulled it apart.

From decks. Term sheets.

Late-night convos with partners who’ve seen it all.

Here’s exactly what VCs are looking for.

Let’s dive in.

Key Factors Venture Capitalists Evaluate

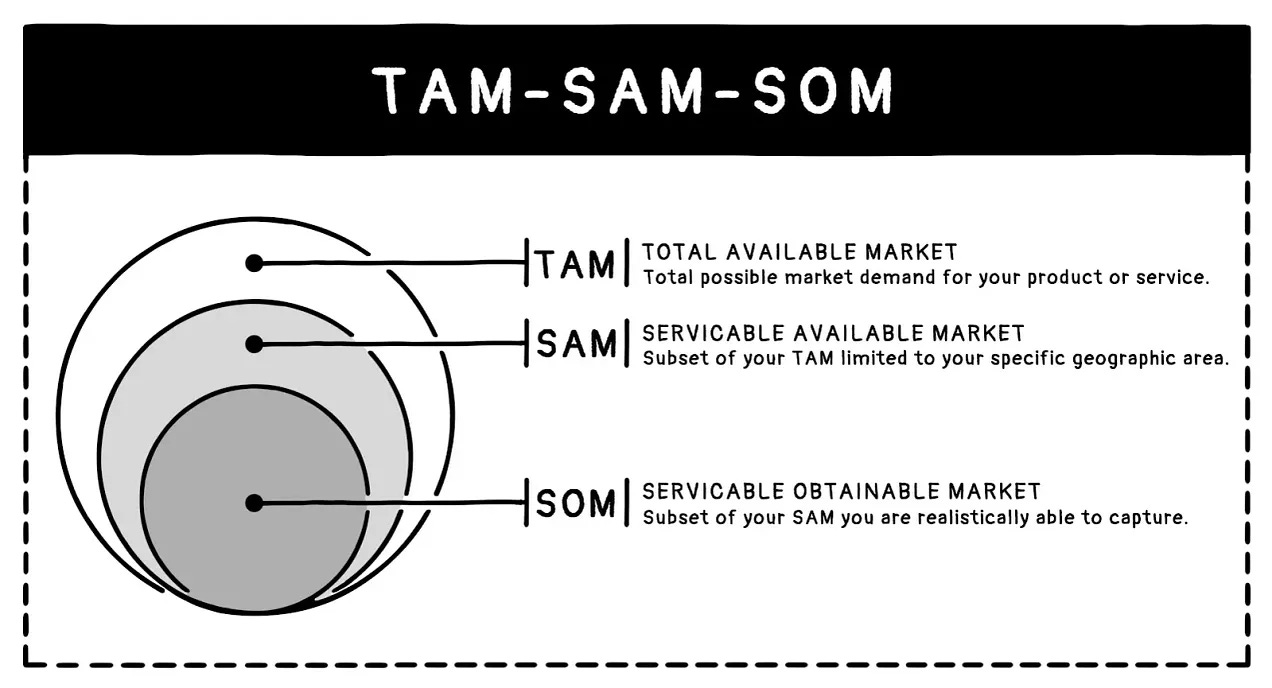

1. Market Size That Makes VCs Salivate

You’re not just pitching your product.

You’re pitching the size of the outcome.

VCs want billion-dollar outcomes. So they back startups in billion-dollar markets.

Your TAM (total addressable market) better be big. And growing.

Ideally with a tailwind behind it: AI, climate, decentralization, healthcare, whatever.

🔥 Stat: Startups entering $1B+ markets are 60% more likely to get funded.

Pro tip: Don’t just drop a big TAM number.

Show how your startup is the one uniquely positioned to dominate it. And use data to back up your TAM estimate.

2. The Team They Want to Bet On

They’re not investing in your idea.

They’re investing in you, and your ability to figure it out when shit inevitably hits the fan.

Things VCs scan for immediately:

Have you built something before?

Do you deeply understand this space?

Can you sell, hire, and build in the same breath?

🔥 Stat: 92% of investors say the team is their #1 investment criterion.

“Bet on the jockey, not the horse.”

3. Proof of Product-Market Fit

Nothing screams “we’re ready to scale” like real users who need what you’ve built.

Not just vanity metrics.

Not just pilot programs.

We’re talking actual retention, usage, MRR, NPS—all the stuff that proves love, not just like.

🔥 Stat: Startups with PMF grow 20–30% faster than their competitors.

4. Scalability. AKA, Where the Money Comes In

Can your revenue grow faster than your costs?

Can you scale to 10x, 50x, 100x without breaking the machine?

VCs care about CAC, LTV, burn multiples, payback periods.

Not because they’re nerds (well, not just), but because these numbers tell them how fast they can pour fuel on the fire.

Rule of thumb: Low CAC, high LTV, and a repeatable growth engine = 💰

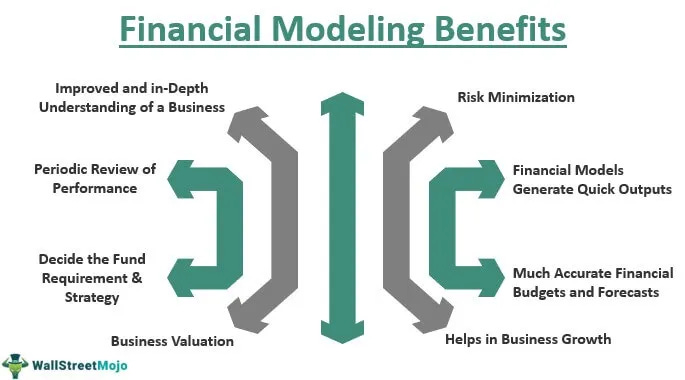

5. Clear Financials

You’re early. You won’t be profitable. Everyone knows that.

But if your runway is 4 months and your burn rate is accelerating? That’s a problem.

🔥 Stat: Startups with 18+ months of runway are 3x more likely to raise follow-on rounds.

Your job: Show a path. Build a model. Be transparent.

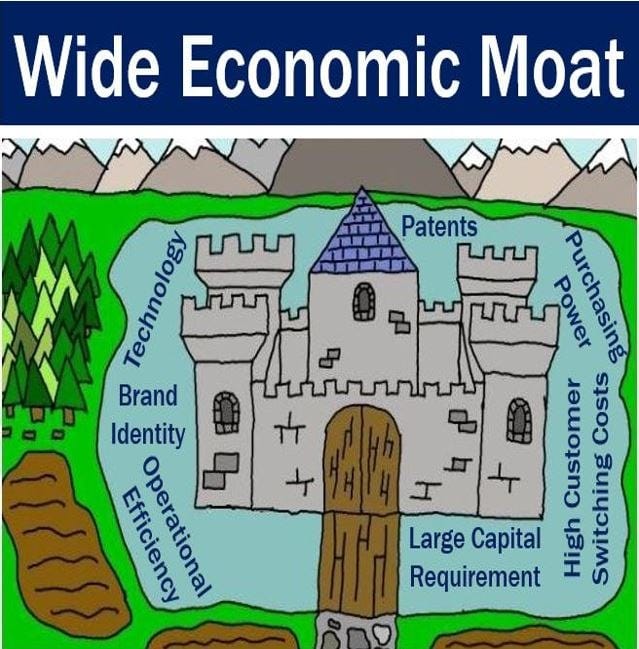

6. A Competitive Edge That’s Defensible

You’re not alone in the market.

Why are you going to win?

Is it proprietary tech?

A network effect?

Distribution power?

Unfair insight?

Whatever it is, it better be hard to copy and easy to believe.

As Peter Thiel said:

“Your advantage must be defensible, otherwise, it’s only temporary.”

7. The Intangibles

Yes, there’s also:

– Founder-market fit

– How you answer tough questions

– How fast you follow up

– How you handle no’s

VCs are watching it all.

They’re pattern-matching to every founder they’ve ever backed, and the ones they regret passing on.

You don’t need to be perfect.

But you need to be prepared.

So… What Do You Do With All This?

Here's your cheat sheet:

✅ Know your numbers

✅ Own your story

✅ Align with the VC’s thesis

✅ Build relationships before you ask for money

✅ When you pitch, lead with traction, not theory

Most importantly?

Be fundable before you ask for funding.

Get everything you need to raise like a pro:

🦄 40 pitch decks that built Unicorns (how Airbnb, Coinbase, Canva got funded)

💰 The Ultimate Investors List of Lists (12k+ VCs, angels, family offices)

📊 The Only Finance Tracker Your Startup Needs

⚡️ The Ultimate Notion Data Room (all key docs you’ll EVER need)

🥇 The Most Successful Investor Update Template

⚖️ SAFE Note Dilution Calculator & Cap Table Builder

👯 Co-Founder Agreement Templates + Legal Clauses You Can't Forget

Grab the full toolkit below with 25% OFF forever.👇

👉 Subscribe now to get the Family Office List + everything else at 25% OFF forever

P.S. Share this with a founder who’s grinding through fundraising hell. This list might save them years.

You likely receive hundreds of pitches.

This isn’t one of them.

Hello @Yoann Berno,

Share deep respect for your work. We share some common philosophical roots.

I am the Founder and Steward of the 100x Farm.

The 100x Farm is a quiet strategy sanctuary for investors and capital stewards with long memories and longer horizons.

No noise. No dopamine. No trend-chasing.

Just deep-cycle clarity earned slowly, shared rarely.

We don’t believe in inbox conquest.

But if the idea of sowing $10,000 seeds to harvest $1 million trees over 20- 30 years feels familiar,

you and your patrons may already belong here.

What if the next 100x isn’t a stock but a forgotten business model hiding in plain sight?

Every thesis is backed by real capital, filtered through over 100 long-cycle lenses before it earns a word.

And if nothing else, this may help you filter what isn’t worth your time.

No urgency. No ask.

Only signal.

Warmly,

The 100x Farmer