Why TRL 5-7 is the Sweet Spot for Climate Tech Investors

Investing in proven tech startups may seem like a safe bet, but the real goldmine lies in that TRL 5-7 window!

Hey 👋 - Yoann here.

Each Saturday, I send out 1 actionable tip to support the growth of your Climate Tech startup, your fund, or your career.

It can be read in less than 5 min.

Enjoy!

🤗 Welcome to the 22 new fans since last Saturday! If you haven’t subscribed yet, join us:

Ah, the Technology Readiness Level (TRL), the most infamous of all Climate Tech indicators.

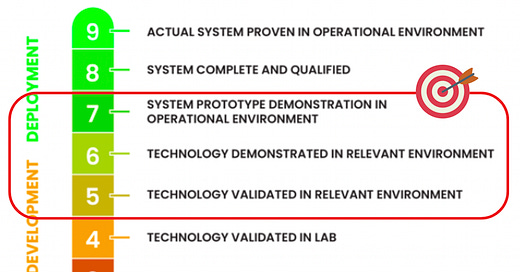

This little number, ranging from 1 to 9, represents the level of development of a technology, from the basic idea (TRL 1) to a fully tested and deployed product (TRL 9).

It was created by NASA, and it works best when applied to physical hardware products, which is perfect for Climate Tech.

So where should you invest to max out your ROI ?

Investing in startups at a low TRL can be risky, as the technology is still in its infancy and there is a lot of uncertainty around whether it will work and how long it will take to bring to market.

On the other hand, investing in startups at a high TRL can be less lucrative, as the technology has already been proven and is closer to market, meaning there is less room for exponential growth.

What does it look like in practice?

Check out this really cool TRL evolution of the Jet Engine.

Jet Engines took a good 25 years to go from TRL 1 to TRL 9.

But only 8 years to go from TRL 5 to 9.

We're talking about 8 years here, which is basically right in the sweet spot for VC investments to be in the money —>Ding, ding, ding 💰💰💰

My recommendation for early-stage investing

So yes, in my experience investing at TRL 5 to 7 might be the sweet spot for angels and early-stage VCs.

At this stage, the technology has been proven in a lab or prototype setting, but has not yet been fully demonstrated in a real-world environment. This means there is still a lot of potential for growth and innovation, but with less risk than investing at a lower TRL.

How does that translate into commercial and impact value?

Elemental Excelerator has developed a climate tech-friendly Commercial Inflection Point (CIP) scale to capture the major milestones from ideation to mass market adoption.

Again, that supports the idea of doubling-down at TRL 5-7.

Any actual data backing this?

For what it’s worth, according to technology case studies by the European Patent Office, startups at TRL 5 to 7 have the highest ROI potential, with a median return of 23.2% compared to 19.4% for startups at TRL 8 and above.

What are historical examples of successful TRL 5-7 startups?

Take QuantumScape, for example.

They received funding at TRL 6 for its solid-state battery technology. QuantumScape went public through a special purpose acquisition company (SPAC) in late 2020, and its market capitalization reached $19 billion just a few months after going public.

Or how about Proterra?

They produce electric buses and charging infrastructure. The company received early-stage funding when its technology was at TRL 6, and has since raised over $500 million in funding. The company's electric buses are now in use in several cities across the United States.

Another one? Desktop Metal

They developed a 3D printing technology for metal parts. The company received early-stage funding when its technology was at TRL 5, and has since raised over $680 million in funding. In 2020, the company went public through a SPAC merger with Trine Acquisition Corp., valuing the company at $2.5 billion.

“I’m a Climate Tech founder, do you have recommendation for me?”

Yessir! Two super valuable tools:

Download this template from the NYSERDA to calculate your TRL

Read the Ultimate Guide to increase the TRL of your new product to quickly climb across TRLs

Conclusion:

As an investor, you wanna put your money behind the technologies that have the greatest potential for impact and ROI. So, where should you be looking?

The real goldmine lies in the sweet spot of TRL 5 to 7.

This is where the technology has been developed to a point where it's ready for commercialization, but before it becomes too expensive or competitive.

It's time to take a bold leap and invest in the technologies that will shape our future. Let's leave incremental gains behind and focus on the real problems of humanity.

Don't wait for the future to happen – create it.

IN CASE YOU MISSED IT

Vaekstfonden - The seeding role of Government Funds in European Climate Tech (Lars Nordal, Head of Fund Investments)

Great episode to better understand the role of sovereign & government funds in the EU Venture Capital scene and their ambition to push the envelope in Climate Tech.

That's all for this Saturday. Simple insights in 5 minutes.

And if you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏

Cheers,

Yoann

Made with Climate 💚