🔥🤯 Wow! 204 new followers joined us this week! Thank you so much! It motivates me to keep growing our community and continue sharing unique content. Please invite your friends and colleagues to join us for a weekly dose of hope and inspiration to keep taking Climate Action.

For all the new folks here, welcome! 👋

Every Saturday, I send out one actionable tip that can be read in 5 minutes to support the growth of your Climate Tech startup, your fund, or your career. Enjoy!

Did you know that Venture Capital has consistently outperformed all other asset classes over the last 25 years?

Did you also know that historically the average angel investment has been around $77,000…?

That means it was a game reserved for the super wealthy.

But this needs to change.

Let’s uncover how virtually anyone could become a climate angel investor with as little as $1,000, making a difference in the fight against climate change while potentially massively growing their wealth.

It’s one of my core beliefs that to fuel this Climate Tech movement, we will have to involve many stakeholders beyond VC funds and create an army of investors to vote with our capital, and help many more people cash in on this lifetime opportunity.

Additionally, investing in early-stage at pre-seed/seed is where it's most needed to shape industries and ecosystems. This is often where it's a matter of life or death for the craziest business ideas and the most ambitious entrepreneurs.

Plus, the European Pre-Seed Funding Gap Is Here And It’s A Problem.

Yes, okay, I hear you, Venture Capital is not for the faint of heart. It takes patience, skills, and most of all access. And there’s huge risk involved.

This is why we have to play this game by the book. Let’s crack open that door and unveil the most fundamental rules to win at this game, be it VCs or Angels.

Rule #1: The Crucial Role of Diversification

Always consider each investment as standalone and not in relationship to the other investments you’ve made before.

In Chess, the Queen is worth infinitely more than a pawn. That’s your darling piece, and you will protect it no matter what.

Angel investing is more a game of Checkers where all the pieces are equal. Once you’ve written a check, it’s gone, and you will have very little influence on it.

Assuming you want to build a portfolio of 10-20 investments with $1-5k tickets, any investment could potentially return 3x your entire portfolio, while the rest will fail.

Now, let's explore why this doesn't matter.

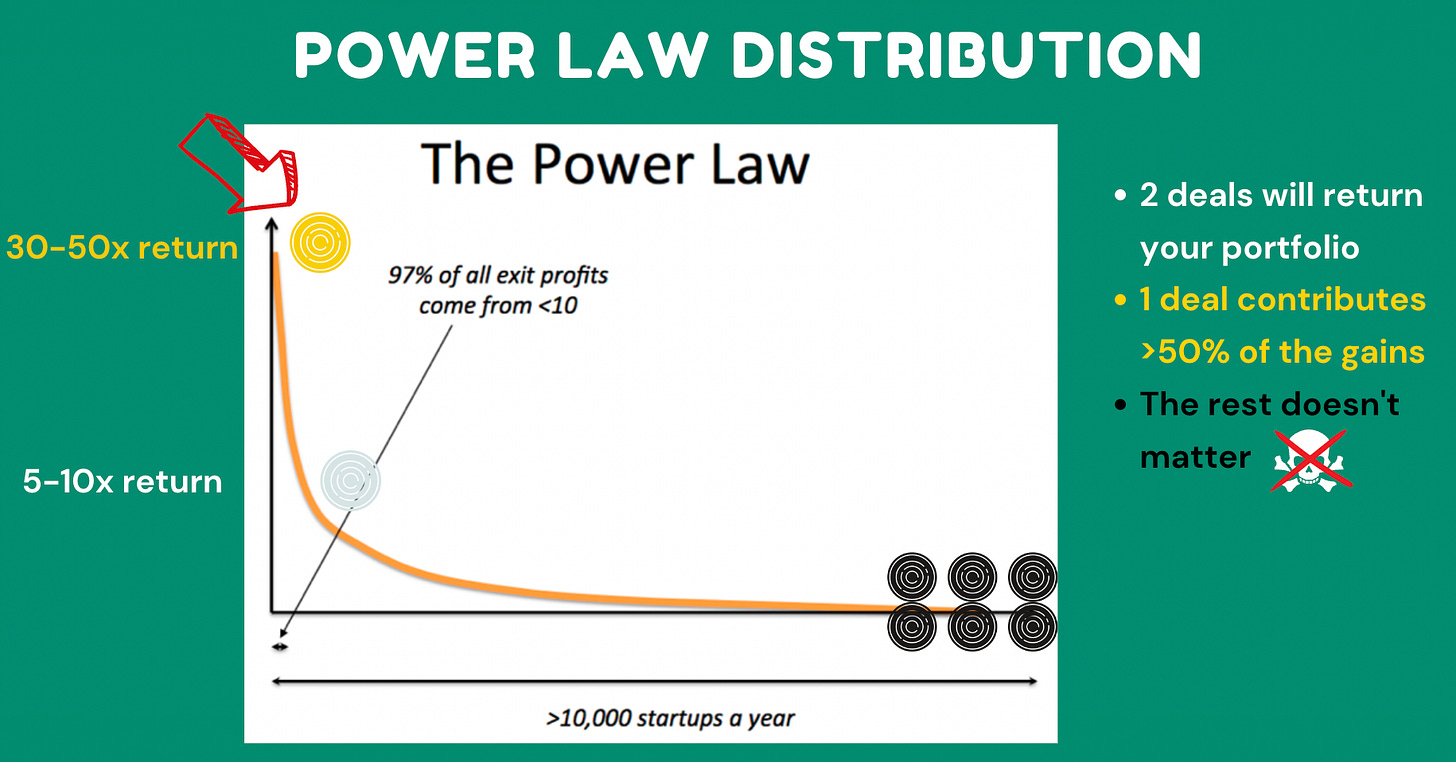

Rule #2: Always follow the Power Law

I’ve written in depth about it, the Power Law drives this whole game.

In a great portfolio of 30 startups, 2 deals will drive returns, and it’s more than likely that 1 deal will contribute more than 50% of the gains. And the truth is it's unpredictable to know which one beforehand.

So it’s a game a statistics. But how do you increase your odds in Climate Tech?

Rule #3: TRL 5-7 is the Sweet Spot for Climate Tech Investors

Climate Tech is mostly about hardware. To eliminate fossil fuels, use less transportation, stop cutting trees, upgrade infrastructure and power our gadgets.

To win big in hardware, you need to invest at the right Technology Readiness Level (TRL). Data shows that TRL 5-7 is optimal in early stage investing.

There’s obviously many more rules and frameworks to succeed in Angel Investing. And I’ll continue sharing them in the future posts.

Building Your Climate Investment Portfolio

If you're excited about becoming a climate angel investor, here's a flight plan to guide you on your journey:

1. Know Your 'Why': Understand your motivations for angel investing and identify where you want to have the most impact.

2. Establish Your Deal Flow: Increase your exposure to potential investments by connecting with angel groups, incubators, and industry professionals in the climate tech space. You can join my community.

3. Understand the Risks and Manage Expectations: Angel investing involves risks, and most investments will fail. Set objectives for your portfolio, and be prepared for a long-term commitment to potentially realize returns.

4. Assess Prospective Deals: Conduct thorough due diligence on startups to evaluate their potential for success. Look for solid, differentiated products and founders with a clear vision and strong values.

Ready for Takeoff?

Many of us are pushed into real estate and buying apartments by societal conventions. What if investing in alignment with your values was the better choice?

Imagine the transformative impact of this simple idea on society.

The good news is that you don't need to be a millionaire to become a climate angel investor. While angel investing involves significant risk, you can start with as little as $1,000.

Make it a small percentage of your overall investment portfolio, diversify and invest ahead of the curve by going early in project that can reshape society.

It's time to spread your wings and start your climate angel investing journey!

I've created a course specifically to help you learn all the rules of superstar investors and become a pro in just 2 days. If you're interested, you can join here: Invest In Climate Tech Like A VC (more info below).

If you have any questions or would like to learn more about a specific topic in angel investing, feel free to send me your thoughts. I answer every email.

Well, that’s all for today.

See you next week.

Whenever you're ready, here is how I can help you:

Join my Invest In Climate Tech Like A VC cohort-based course: In just 6h of live class, you'll get all the resources, tips and tricks to start investing in Climate Tech startups that change the World. Join 200+ students here.

We go in depth and cover Financial Requirements, Risk Management, Deal Flow, Access, Syndication. You won’t find that stuff anywhere else. It’s super practical, actionable, and fun. And big perk, I’ll let you in my private investor community to join awesome deals.

If you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏