Read time: 5 min

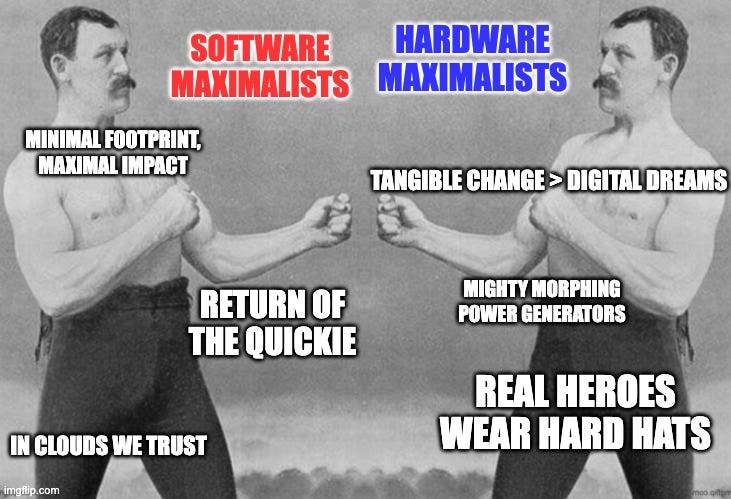

Climate VC is a tale of two camps

🔴 In the red camp, we have Software Maximalists. These guys are chasing the next viral sensation in the digital world. Often, they're the quick-hit VCs looking for rapid returns to satisfy their LPs. But, ultimately, they’re playing it safe; not daring enough to make bolder, more impactful bets.

🔵 Fighting for the blues are the Hardware Maximalists. These peeps build tangible innovations meant to last. Of course, it takes hard work! But it’s OK — they’re betting big on the long game, prioritizing real-world impact over immediate returns. Whether or not this aligns with their investors is… their business 👀

But to max out impact and financial success, companies need to strike a killer combination of BOTH 👇

Software-enabled hardware = the middle ground

Software-enabled hardware is where amazing physical inventions (hardware) gain exponential power and precision (software).

But Yoann, “Hardware is hard!”

Yes, that’s what most VCs say. They are afraid of hardware because it’s complex, time-consuming, and difficult to get through regulation. Sometimes it can take 10-20 years for a product to scale globally 🤯

The solution? Pair it with software.

Climate is the perfect scene for software-enabled hardware

Hardware is becoming increasingly sexy on the climate scene, mostly because of the monumental impact it promises.

But when enabled by software, that’s the sweet spot. Here are a few success stories…

🚜 InnerPlant is revolutionizing precision farming thanks to hardware sensors, drones, and automated machinery that monitor crop conditions. Then, software algorithms analyze this data to optimize farming practices. The result? Better crop yields and boosted sustainability with precise irrigation, fertilizer application, and pest management!

🪰 Entocycle is changing the way we feed animals using insect farms. They build climate-controlled growth units to optimise conditions in which black soldier flies breed and develop. Then, this hardware is complemented by machine vision software for precise population monitoring and lifecycle tracking.

And here are some other emerging areas where software can enable already-powerful hardware…

☢️ Nuclear fusion

🔵 Sophisticated reactor control systems manage plasma and energy extraction

🔴 AI software optimizes performance and ensures reactor safety

💦 Water management solutions

🔵 Sensors monitor environmental conditions like flow rates and water quality

🔴 Software analyzes this data to improve irrigation and reduce waste

💨 Carbon Dioxide Removal (CDR)

🔵 Capture systems physically remove CO2 from the atmosphere or emissions

🔴 Efficiency-boosting software supports emission tracking and verification

🪨 Carbon Mineralization

🔵 Reactors facilitate the chemical conversion of CO2 into stable minerals

🔴 Software algorithms optimize the reaction conditions for maximum carbon capture

🧠 Biologically-Inspired Computing

🔵 Hardware mimics the brain's neural networks for processing information

🔴 Algorithms enhance computational efficiency and power usage

☁️ Atmospheric Water Harvesting

🔵 Condensers collect moisture from the air, converting it into water

🔴 Software predicts optimal harvesting times and regulates energy use

🌿 Artificial Photosynthesis

🔵 Reactors use catalysts to convert CO2 into fuels or chemicals with sunlight

🔴 Simulation software optimizes the process and predicts output

What's the secret to making it as a hardware investor?

👉 Investing at the right Technology Readiness Level (TRL)

This is a strategic move that pays off. For example, jet engines soared from TRL 5 to TRL 9 in just eight years 🤯, enabling commercial flights far quicker than anticipated.

Parting thoughts

The investors who will make it big in this game are those who dare the most and strike the right balance between impactful hardware and scalable software.

Let's support the most daring and imaginative founders who strive for a drastically different and better world 🌎

I leave you with this quote and a truly inspiring video on “The Power of Visioning” by Donella Meadows:

“If we don’t know where we want to go, it makes little difference that we make great progress. Yet vision is not only missing almost entirely from policy discussions; it is missing from our whole culture.”

Want to join our Climate Investor community?

👉 Join the Climate Insiders investor community 🚀 Whether you are looking for unique deal flow, wanting to develop your Angel track, or simply seeking exposure to the best projects in the space, join us here.

And if you are enjoying this newsletter, the best support would be to recommend it to a Climate friend or colleague 🙏 Let’s grow this movement together.

Cheers,

In Canada cleantech investments are primarily in software. It’s very difficult to get attention or funding for anything hardware related, which is a huge miss. I hope more investors see the value of hardware when it comes to sustainability tools and more value in put on hardware solutions.

I really liked the exercise at the end of the video 🙌🏻